sees his time at work as an investment in his future—not just a paycheck

for - worker-owned cooperative - attitude shift - from paycheck - to investment in future

sees his time at work as an investment in his future—not just a paycheck

for - worker-owned cooperative - attitude shift - from paycheck - to investment in future

They had parties, we got the hangover<br /> by [[Ruth Sunderland]] for The Guardian<br /> accessed on 2025-09-06T12:17:48

세계화에 따른 디플레이션 압력으로 금리가 장기적으로 하락했고

1.생산비용 하락 * 제조업이 중국,동남아시아 등 임금이 저렴한 국가로 이전 * 같은 제품을 훨씬 싼 값에 생산 가능 * 선진국으로 수입되는 제품 가격이 크게 하락

2.노동시장 경쟁 심화 * 글로벌 노동력 공급 급증으로 임금 상승 압력 완화 * 선진국 제조업 일자리 감소로 임금 협상력 약화

3.공급망 효율화 * 국제 분업으로 생산 효율성 증대 * 운송비, 통신비 하락으로 거래비용 감소

이런 이유들로 인해서 물가 상승률이 지속적으로 낮아졌고, 중앙 은행은 경기 부양을 위해서 금리를 낮춰야 했음

싸니까 그냥 많이 사는거 아님? 개이득이라고 생각할 수 있는데 전혀. 소비자 입장에서는 더 기다리면 많이 살 수 있으니까 일단 대기, 그리고 기업 입장에서는 수익성이 떨어져서 투자에 소극적. 이렇게 경제 전체에 활력이 떨어짐

The COVID experience provides a cautionary tale. The unstable economic outlook and higher interest rates meant banks were more cautious about financing some renewable energy projects. And according to the International Energy Agency, small to medium-sized businesses became more reluctant to invest in renewable energy applications such as heat pumps and solar panels.

for - adjacency - economic slowdown - COVID - less investment in renewables

Affect regulates another aspect of the performative relationship between past, present and future. Where the performativity of expectations relies on credibility, on being believed and expected, affect relies on (a form of) emotive investment.

for - adjacency - imagined futures - affect - performative - expectations - credibility - emotive investment

adjacency - between - affect - imagined futures - performative - expectations - credibility - emotive investment - adjacency relationship - This sentence is a highly integral and convergent one that brings together many important adjacent ideas - Affect (emotions) is important because if we are emotionally invested in a story of an imagined future, it gives it credibility

W przeciwieństwie do Czech, kraje takie jak USA czy Włochy wciąż nakładają wysokie podatki na zyski z kryptowalut, sięgające od 15% do nawet 42%. Polska, z kolei, utrzymuje niezmienne zasady opodatkowania, traktując dochody z kryptowalut jako przychody z kapitałów pieniężnych i obciążając je 19% podatkiem.

Czechy zdecydowały się na rewolucyjne zmiany w przepisach dotyczących kryptowalut, które mogą przyciągnąć inwestorów z całej Europy. Premier Petr Fiala ogłosił, że sprzedaż kryptowalut, takich jak Bitcoin, będzie całkowicie zwolniona z podatku, pod warunkiem, że transakcja nastąpi co najmniej trzy lata po zakupie.

Cena złota przekroczyła 2700 USD za uncję Od początku tego roku złoto wyceniane w USD podrożało o blisko 32%, a w PLN o niecałe 33%. Metal zmierza do osiągnięcia najlepszego roku notowań od 45 lat.

Gold has risen in price by 33% since the beginning of the year and is now worth PLN 10,780 per ounce. This is almost the best year for this precious metal in 45 years.

It's either all button down and if you can't prove it, if you can't quantify it, if you can't put a number and financialize it,

This is where SROI (Social Return on Investment) DATA will help us bridge the gap In a recent call in Ireland a football team scored a 17:1 SROI score for their impact on community

BP investiert in die Erschließung neuer fossiler Lagerstätten und hat damit den Plan aufgegeben, seine Öl- und Gasproduktion bis 2030 um 25% zu senken. Dieser Plan war bereits eine Abschwächung des ursprünglichen Ziels einer Reduktion um 40%. Wie andere große Ölfirmen konzentriert sich BP auf kurzfristige zusätzliche Gewinne aus dem Öl- und Gasgeschäft statt auf die - ohnehin zu geringen - Investitionen in die Energiewende. DIEEE Stategie treibt die globale Erhitzung weiter an. https://www.theguardian.com/business/2024/oct/07/bp-abandoning-plan-to-cut-oil-output-angers-green-groups

"ego investment" ist das problem.<br /> wir mit der impfung seine gesundheit geopfert hat,<br /> der kann nicht zugeben dass die impfung ein fehler war,<br /> der hat falsche hoffnung ("mich trifft es nicht") bis zum bitteren ende.

You can’tinvest based on a tearsheet, but when I'mgoing to go analyze abusiness and breaksomething down,especially when I wasyounger, if I didn't reallyknow a business thatwell and I wanted to getmyself oriented in ahurry, I'd spend 5 or 10minutes with the ValueLine page and pages forthe industry, then Iwould read severalyears’ worth of annualreports and Ks and Qs.But I'd start with thetear sheet and then I'vegot a better long-termsense about where thisbusiness has been.

The study analysedindirect dependencies on ecosystem services and concluded that EUR510 billion, or 36% ofthe EUR 1.4 trillion in investments held by Dutch financial institutions, is highly or very highlydependent on one or more ecosystem services.

for - stats - ecosystem disruption and financial losses study - Dutch investors risk 510 billion EUR or 36% of the Dutch 1.4 trillion EURO investment is at risk

according to the Intergovernmental Panel on Climate Change’s (IPCC) 6th Assessment Report (AR6), US$384 billion has so far been spent on climate action in urban areas, representing just 10% of what is necessary to build low-carbon and climate-resilient cities.

for - stats - planetary emergency - 2024 - still low investment in cities

stats - planetary emergency - 2024 - still low investment in cities - IPCC 6th Assessment Report - US $384 billion invested globally in urban areas - This is 10% of what is necessary to build low-carbon and climate resilient cities

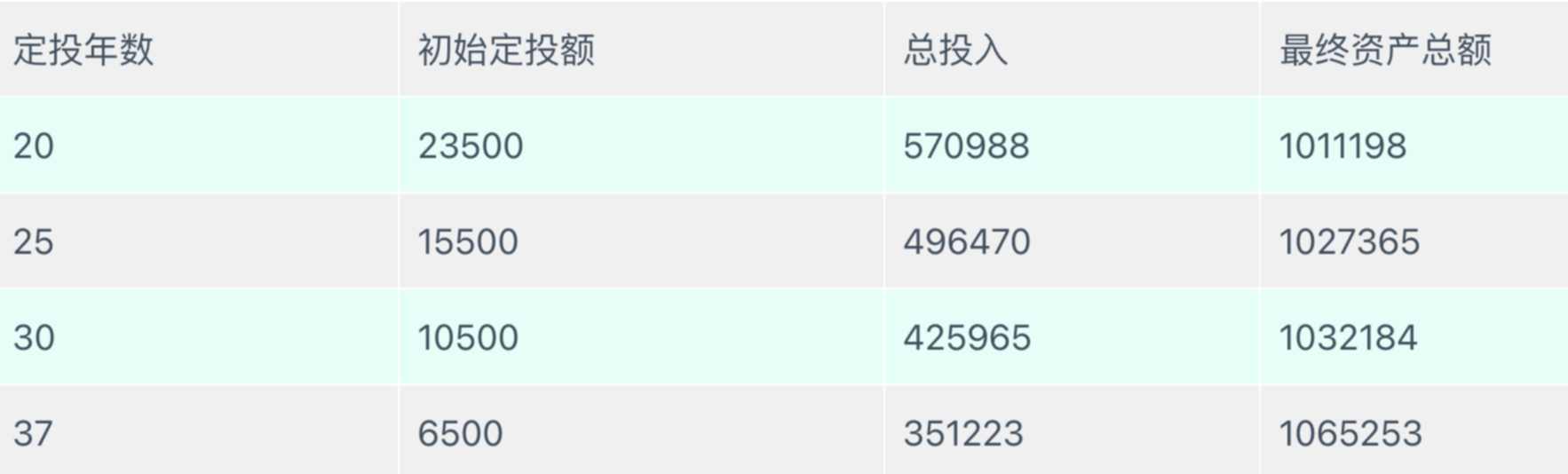

根据自己的年龄,可以依据上表的计算结果估计第一年需要的定投量。比如67岁退休,而现在是30岁,退休前还可以定投37年。那么想要退休时拥有百万欧元的资产,第一年要定投6500欧元,相当于每月投入542欧元。当然股市是有波动的,假如在定投的最后几年赶上了超级熊市,可能资产并不能在退休时达到100万欧元,但是只要再等等,总会等到牛市的。

定投年数和初始定投额

这四步骤旨在指导个人如何有效地管理和增加财富。

MSCI World

MSCI World是一个国际性的股票指数,由摩根士丹利资本国际公司(Morgan Stanley Capital International,简称MSCI)编制。该指数旨在反映全球发达市场中大型和中型股票的表现。MSCI World指数涵盖了23个发达国家,包括美国、日本、英国、加拿大、法国、德国等国家的股票市场,是衡量全球股市表现的重要指标之一。投资者通过投资MSCI World指数相关的金融产品,如指数基金或交易所交易基金(ETF),可以实现对全球发达市场股票的广泛投资。

ETF指数基金和个股比有什么好处呢?ETF是大量股票的集合,买它可以很容易做到分散投资。全世界所有的大公司同时倒闭或者亏损的可能性是微乎其微的,所以持有ETF的风险是比较小的。而投资个股,运气不好就可能碰上大众尾气门这样的事件,对收益打击很大;运气再不好一些公司还可能会倒闭,血本无归。想自己买大量个股进行分散投资,则需要花费大量的时间和精力。

投资指数基金的盈利逻辑也很简单,只要全球经济长期来看是增长的,那么买入MSCI World全球发达国家股票指数基金,我们就能盈利。

ETF指数基金和个股比有什么好处呢?ETF是大量股票的集合,买它可以很容易做到分散投资。全世界所有的大公司同时倒闭或者亏损的可能性是微乎其微的,所以持有ETF的风险是比较小的。而投资个股,运气不好就可能碰上大众尾气门这样的事件,对收益打击很大;运气再不好一些公司还可能会倒闭,血本无归。想自己买大量个股进行分散投资,则需要花费大量的时间和精力。

股票期权基础知识 厦门大学 16讲

we're not in the economy of the 1950s anymore. And we act as though we are, that finance is this productive force and it's building, it's building wealth. Well, for the most part, it's not. It's, there's so much financialization, so many financial assets, that they've become an extractive force. And a big piece of this 00:06:37 is that we're not really distinguishing between productive investments and speculative investments

for: quote - Marjorie Kelly, quote - finacialization, progress trap - financialization, progress trap - capitalism, speculative investing

quote: Marjorie Kelly

Oil and gas producers account for only 1% of total clean energy investment globally.

for: stats - oil and gas industry - clean energy investments

comment

Ausführlicher Kommentar zu den 2,4 Billionen (Tausend Milliarden, im Artikel falsch übersetzt) Dollar, die laut dem COP27-Bericht von 2022 erforderlich sind, um Klimaschutz und -Anpassung in den Ländern des globalen Südens (außer China) zu finanzieren. Der auf Konsens ausgerichtete COP-Prozess sei außerstande, die nötigen Entscheidungen zu treffen. Der Betrag entspricht grob den aktuellen weltweiten Militärausgaben. https://www.repubblica.it/commenti/2023/11/19/news/cambiamenti_climatici_spesa_annua-420689085/?ref=RHRT-BG-I279994148-P4-S3-T1

John Kerry besucht in dieser Woche China für dreitägige Gespräche mit seinem Pendant Xie Zhenhua. Konkrete Ergebnisse dieses Treffens werden von den meisten Experten nicht erwartet. Ein mögliches Ergebnis könnten regelmäßige Gespräche beide Seiten zur Abstimmung ihrer Dekarbonisierungspolitik sein. Hintergrundbericht in der New York Times. https://www.nytimes.com/2023/07/15/climate/us-china-climate-talks.html

Investment Strategies for Beginners: A Comprehensive Guide

Master investment strategies for beginners in our comprehensive guide. Learn essential strategies to kickstart your financial journey. Start smart! Explore here >> Investment Strategies for Beginners: A Comprehensive Guide

Carbon Capture and Storage wird von der fossilindustrie, unter anderem vom Präsidenten der Cop28, Sultan Al Jaber, als Methode dargestellt, fossile Energien CO2 frei zu machen. Eine Studie über zwei experimentelle CCS-Projekte in Norwegen stellt in Frage, ob die Speicherung von CO2 unter dem Meeresboden überhaupt sicher zu realisieren ist. In beiden Fällen wurden geologische Besonderheiten entdeckt, die zu völlig anderen Entwicklungen in den Lagerstätten führte, als man es angenommen hatte.

the top 1% now being responsible for 17% of total emissions, the top 10% for 48%, and the bottom half of the world population for only 12% (in 2019).

Quotable carbon inequality stats: - the top 1% responsible for 17% of total emissions, - the top 10% for 48%, - the bottom 50% for12% - stats carbon inequality - quote carbon inequality - 2019

// A key question is also this: - what are individuals using those carbon emissions for? - is it being used just for luxury consumption - or is it being used to develop and actionize scalable low carbon strategies? - if it is the later, it could be seen as a de-carbon investment

By making an investmentup front to alleviate poverty, the evidence suggests that we will be repaid manytimes over in the lower costs associated with a host of social problems.

From a "business perspective", the US Government would be better off by minimizing the cost of poverty.

(Original highlight on 2022-10-18)

Was man über ein Investment mittels Robo-Advisor wissen

Interesting Article - dedicated to the Question, if an Investment by using Roboadvisory Services makes sense for you or not?

I just frowned at my cardboard boxes.I’m aiming to build something similar out of wood soon. But I also had an idea to build a bookshelf with drawers incorporated, a row of vertical draws on both sides of the shelf and/or one down the middle. Ideally creating book cubbies between the drawers where I could organize related books next to appropriate zettles. Not sure how attached to that idea I am though, seems like something I will like for the moment and find very novel in the future (pun certainly intended).

reply to GnauticalGnorman

Don't frown at cardboard. Everyone starts their journey with a single card and a humble box. Filling up a first box is an accomplishment that gives you time to dream about the box you want to have.

Of potential interest, the cost of index cards to fill these files will be almost the investment in the box itself. Is this similar to the rule of thumb in the art world that the price of the frame should reflect the investment in the artwork?

One goal is to generate positive income, also known as cash flow. Another goal is to increase the value of our investment, also known as capital appreciation.

What mutual fund SIPs are really about

Mistiming risk is minimal or very short-lived in all debt funds (other than gilt funds) and in hybrid categories other than aggressive hybrid.

it is only in equity funds/hybrid aggressive funds that you can turn market volatility to your advantage, by investing on dips and lowering costs. In the absence of that volatility, you get no averaging benefit; in such funds, as long as your timeframe is right, it doesn’t matter whether you invest through SIP or lumpsum.

Replicating scientific results is tough—But essential. (2021). Nature, 600(7889), 359–360. https://doi.org/10.1038/d41586-021-03736-4

A corporation whose principal purpose is to derive income from property is usually considered a specified investment business, and is not eligible for the small business deduction.

What happens in my case? Would the principal purpose be categorized as mentorship or investment.

10 Ideas to Start a SaaS Business in 2021

Software as a service, or SaaS, is one of the most promising business models in 2021. It’s popular among entrepreneurs, investors, and customers alike. Learn about the most promising ideas you can tap into to build your own SaaS startup and make it successful.

The EU looks towards green coronavirus recovery. (n.d.). World Economic Forum. Retrieved May 29, 2020, from https://www.weforum.org/agenda/2020/04/european-politicians-ceos-lawmakers-urge-green-coronavirus-recovery/

Conley, D., & Johnson, T. (2021). Opinion: Past is future for the era of COVID-19 research in the social sciences. Proceedings of the National Academy of Sciences, 118(13). https://doi.org/10.1073/pnas.2104155118

Knowles, R., Mateen, B. A., & Yehudi, Y. (2021). We need to talk about the lack of investment in digital research infrastructure. Nature Computational Science, 1(3), 169–171. https://doi.org/10.1038/s43588-021-00048-5

Could COVID-19 mark a ‘turning point’ in the climate crisis? (n.d.). World Economic Forum. Retrieved May 29, 2020, from https://www.weforum.org/agenda/2020/05/green-recovery-can-revive-virus-hit-economies-and-tackle-climate-change-study-says/

They fail to recognize the value of an initial investment of time in future productivity.

The Rights Retention Strategy provides a challenge to the vital income that is necessary to fund the resources, time, and effort to provide not only the many checks, corrections, and editorial inputs required but also the management and support of a rigorous peer review process

This is an untested statement and does not take into account the perspectives of those contributing to the publishers' revenue. The Rights Retention Strategy (RRS) relies on the author's accepted manuscript (AAM) and for an AAM to exist and to have the added value from peer-review a Version of Record (VoR) must exist. Libraries recognise this fundamental principle and continue to subscribe to individual journals of merit and support lucrative deals with publishers. From some (not all) librarians' and possibly funders' perspectives these statements could undermine any mutual respect.

Meeter, M., Bele, T., Hartogh, C. d., Bakker, T., de Vries, R. E., & Plak, S. (2020, October 11). College students’ motivation and study results after COVID-19 stay-at-home orders. https://doi.org/10.31234/osf.io/kn6v9

IZA – Institute of Labor Economics. ‘COVID-19 and the Labor Market’. Accessed 6 October 2020. https://covid-19.iza.org/publications/dp13664/.

A Different Theory of Economic Development | Inside Higher Ed. (n.d.). Retrieved September 25, 2020, from https://insidehighered.com/blogs/confessions-community-college-dean/different-theory-economic-development

Senior, J. (2020, July 21). Opinion | I Spoke With Anthony Fauci. He Says His Inbox Isn’t Pretty. The New York Times. https://www.nytimes.com/2020/07/21/opinion/anthony-fauci-coronavirus.html

Welfare States, Labor Markets, Social Investment and the Digital Transformation. COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved August 1, 2020, from https://covid-19.iza.org/publications/dp13391/

Alfaro, L., Chari, A., Greenland, A. N., & Schott, P. K. (2020). Aggregate and Firm-Level Stock Returns During Pandemics, in Real Time (Working Paper No. 26950; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w26950

van Binsbergen, J. H., & Opp, C. C. (2020). The Effectiveness of Life-Preserving Investments in Times of COVID-19 (Working Paper No. 27382; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27382

Falato, A., Goldstein, I., & Hortaçsu, A. (2020). Financial Fragility in the COVID-19 Crisis: The Case of Investment Funds in Corporate Bond Markets (Working Paper No. 27559; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27559

Firm-level Expectations and Behavior in Response to the COVID-19 Crisis. COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved August 5, 2020, from https://covid-19.iza.org/publications/dp13253/

Haddad, V., Moreira, A., & Muir, T. (2020). When Selling Becomes Viral: Disruptions in Debt Markets in the COVID-19 Crisis and the Fed’s Response (Working Paper No. 27168; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27168

FEPS. COVID Response Webinar: EU Spending that Empowers. For an inclusive and more resilient Europe. (2020, April 30). https://www.youtube.com/watch?v=0pQeCANMzss

Barbaro, N., Richardson, G. B., Nedelec, J. L., & Liu, H. (2020). Assessing Effects of Life History Antecedents on Age at Menarche and Sexual Debut Using a Genetically Informative Design [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/xqfg8

Investing in a New US Climate

Investing overseas as a US citizen - Scott Schwartz MBA, is Certified Investment Management Analyst, and check out his views about investing in a new climate.

Individual Financial Planning

Alexander Beard Group - Financial advisor for individuals, we use a variety of approaches to ensure that your individual financial planning requirements are comprehensively met.

We are an international financial and emigration services organisation

Alexander Beard Group - International financial emigration services organisation, from life insurance, pensions to investment, we can help you in South Africa, USA, UK & France

Forscher, P. S., Wagenmakers, E.-J., DeBruine, L. M., Coles, N. A., Silan, M. A., & IJzerman, H. (2020). A Manifesto for Team Science [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/2mdxh

UKCDR - COVID-19 Research Project Tracker

Before embarking on the effort to scrape the web for new password breaches and compare against your entire user database you also need to consider the ROI. The beauty of the pwned passwords API and this, and other, implementations of it is that you can get a good improvement in your account security with comparatively little engineering effort.

Kleinman, M. (2020 April 16). Innovation agency Nesta backs UK edtech start-up BibliU. Sky News. https://news.sky.com/story/innovation-agency-nesta-backs-uk-edtech-start-up-bibliu-11974089

Big banks beat profit expectations but warning signs grow

Note: article is an update to a previous report on large US Banks - https://uk.reuters.com/article/uk-goldman-sachs-results/goldman-sachs-profit-beats-estimates-boosted-by-strong-equities-trading-idUKKCN1UB1B3?il=0

Heading analysis

Jack Phillips and ROI. This page describes the Phillips Return on Investment model. The model as presented here is an alternative to Kirkpatrick's model. There's a bulleted list of the components of the model as well as a nice graphic that briefly describes the levels. There is an explanation about how to apply the model, though I think more information would be needed for real world practice. Rating 4/5

That context is also encompassing the behaviour of production companies, many of which have acquired the short-term profit expectations of the bubble years and are more engaged in stock buybacks, cost cutting, tax avoidance and quick deals than in R&D, training or other innovative activities with a longer-term horizon.36 As a result, massive amounts of money are sitting idle in the corporate world, in banks, financial companies and production ones. The longer this situation lasts, the harder and deeper the negative consequences on the economy and society

由於 USDT 的發行方式會使得其交易量高於市值數倍,其中很多部分是交易所的「資訊流交易」,意思是交易的 USDT 比實際存在的 USDT 多──交易所本身並不存在交易帳面上同等數量的 USDT,因此當 USDT 需求數量大增,使用者要提領 USDT 回冷錢包存放時,交易所很容易發生 USDT 缺貨的情況:這是這一波避險潮的潛在危機,若是使用者無法提領 USDT,對交易所的商譽衝擊將會相當嚴重,但目前投資人對於 USDT 的需求相當強勁,各大交易所正發生 USDT 嚴重缺貨的狀況。

<big>评:</big><br/><br/> 「稳定」似乎成了过去这一年圈内人士心心念念的年度词汇?此时倒不妨把明斯基(Hyman Minsky)的《稳住不稳定的经济》(Stabilizing an Unstable Economy)一书翻出来,借以寻求慰藉。对于经济单位来说,其收入-负债关系可以分为三类:对冲、投机和庞氏融资。对冲融资,其收入可以支付本息。投机融资,短期内收入只能偿还利息而不能偿还本金,必须债务展期。庞式融资,收入连利息也还不上,借新还旧,债务不断增加,必须再融资或变卖资产。在从上一个衰退刚刚走出时,债务融资的安全边际很高,经济体中以稳健的对冲融资为主。而随着经济的稳步上升,由于资本的逐利属性,经济体中投机和庞式融资逐渐增多。当投机、庞式借贷人比例太大时经济就变得不稳定。 <br/><br/> 2018 年年初加密货币市场的资本狂热曾让许多人担忧这条所谓的「庞氏融资链」是否会断裂,而后来的事实证明,这盘的确崩了。此时再让我们反过头来回看稳定币——一直以来,USDT 因审计不公开、中心化和涉嫌超额发行以操纵比特币价格而饱受质疑,甚至也有人将 USDT 视为庞氏骗局。对此,发行方泰德公司 (Tether Limited)的行事哲学是:不透明性可以增加流动性,但这并不意味着我们不要透明性。提供有效的、加总的信息要比提供原始信息更有助于流动性。但是当下这场缺币事件却足以警示,稳定币也有不稳定的时候,而且这种不稳定的状态可能远超发行方影响范畴。它催使投资客们反思,当威权主义的治理精神从一开始就充盈了整个流通过程,「流动性」是否已然名存实亡?

Ontario’s postsecondary institutions play an important role in equipping students with the skills, knowledge and competencies required to succeed in a rapidly changing social, economic and technological world. Ensuring that postsecondary institutions across the province are equipped with the right space and technology is important to delivering quality higher education. To support this, the Province will provide more than $3 billion in capital grants to postsecondary institutions over the next 10 years.

3 billion

Recognizing Indigenous Institutes builds on the Province’s historic $56 million investment in Indigenous learners, announced in the 2017 Budget, as an important part of a thriving postsecondary system and a key step towards reconciliation with Indigenous peoples in Ontario

$56 million

That is why the government will invest an additional $63 million over three years to create the first Ontario Training Bank to serve as a one-stop shop for employers, job seekers and workers to access the skills training that meets their needs. The new Ontario Training Bank includes a refreshed set of services and programs3 that will: Help employers invest in the skills of their workers, and come together to train and recruit new talent; Provide workers with the ability to grow in their jobs and adapt to technological changes; Provide employers with access to essential skills upgrading, including digital literacy for their workers at no cost to the employer; Provide job seekers with support to access quality training to secure in-demand jobs and meet employers’ hiring needs; and Bring employers, industry associations and training providers together to develop skills programs that are tailored to the needs of the local economy.

Ontario’s skilled trades create careers leading to secure jobs and a good quality of life, and are also vital to the health and growth of the economy. Building on consultations across the province, the government is investing $170 million over three years in the new Ontario Apprenticeship Strategy. This investment will include: Expanding the Ontario Youth Apprenticeship Program (OYAP), providing more high school students with trades-related hands-on learning opportunities; Improved guidance counselling resources and local labour market information for students, parents and educators; A new grant to promote pooled group sponsorship models for apprentices; A Local Apprenticeship Innovation Fund to increase opportunities for apprentices and encourage engagement within the apprenticeship system across Ontario, as well as support regional, local or sector-specific pilots where there is demonstrated market need; and Continuing education opportunities for trade professionals.

Preparing Secondary School Students for the Workforce Preparing Ontario students for the jobs of today and tomorrow is part of the government’s plan to create jobs, grow the economy and help people in their everyday lives. The Province has taken the following steps: In March 2017, Ontario launched 29 pilot projects across the province for the Career Studies course. More than $10 million per year for four school years has been invested to help schools create more experiential learning opportunities for students. Since 2014, Ontario has funded close to 300 Experiential Learning pilots across the province, helping students explore a wide array of career opportunities both inside and outside the classroom

Students, parents, and educators have identified Grades 7 and 8 as crucial years where greater support is needed. That is why the government will invest more than $120 million over the next three years to help students prepare for success in high school by ensuring that flexible supports are available in response to local needs and priorities.

Province is introducing a Good Jobs and Growth Plan with $935 million in new investments over the next three years as well as long-term infrastructure investments.

Even in central Ho Chi Minh City, top-end properties are priced US$3,000 to US$5,000 per square metre, well below Bangkok where equivalent properties can cost up to US$7,000 to US$9,000 per square metre, and 5 per cent the price of Hong Kong. Annual rental yield for some high-end apartments in major cities at currently at 7 to 8 per cent, which is 1.5 to 2.5 per cent higher than those in Hong Kong, Bangkok and Singapore, according to Vina Capital.

We favor spreading priceand risk by building up and averaging out of positions over time rather than speculating onspeculation. A committed capital structure with significant capital reserves for staged follow-onsgives us the flexibility to build up our investments independent of market sentiment. We areshielded from having to dump assets on the market to honor redemption requests, avoiding thedreaded “death spiral” which can plague more liquid fund structures.

We fund the development of decentralized information networks coordinated by a scarcecryptoasset – or token – native to the protocol. Our thesis is that decentralization andstandardization at the data layer of the internet is collapsing the production costs of informationnetworks, eliminating data monopolies and creating a new wave of innovation.

Most of the use cases today involve compensating machine work (transaction processing, filestorage, etc.) with tokens: the building blocks of decentralized applications. But the greatestlong-term opportunity is in networks where tokens are earned by end-users themselves.

The way to play a consolidating market is to investheavily into the consolidating incumbents (which are likely to continue growing strongly for along period of time) and to invest progressively in the insurgent platforms that will grow tocommoditize the incumbent business models and create a new wave of innovation. We arefocused on the latter

Pantera Capital has had a thesis of investing into local exchanges since the inception of its venture capital fund. Local exchanges have an advantage of a local team who understands the culture and marketing of a specific geography in addition to having the relationships for banking and regulations. In June 2014, Pantera investigated and became the lead US investor in the largest cryptocurrency exchange in Korea, Korbit. Korea was a compelling geography for a local exchange investment because of the country’s familiarity with virtual currencies, becoming one of the first countries to adopt them for gaming, having a government that is pro-innovation, having a large mobile ecosystem.

You want your reward to give you greater awareness, greater affinity with life and a greater sense of your value and purpose in the world--not the value and purpose that you invent for your own delights, but the value and purpose that are intrinsic to your being here. This value cannot be exhausted. It will not leave you and will only grow as greater attention, time and energy are devoted to its expression and experience.

he expectation of romance in relationship exacts an exorbitant price, both immediately in terms of time, energy and attention and in a long-range sense. People lose so much over this pursuit and how little is their reward--a few moments of self-inflated pleasure or self-abandonment or a few moments of physical sensation, none of which can be maintained for long. The reality of the relationship can seem very depressing in contrast to the thrill of romance. That is because people invest in the romance and not in the relationship.

Most of the pleasures that are damaging to people are damaging because the investment is great and the reward is very small. In many cases, there is no reward at all. There is only investment and reinvestment. Here we have the contrast between fantasy regarding the pleasure and the real experience. How often have you been disappointed by the real experience of something because the anticipation was so great and so inflated and you had invested so much? Then the real experience came, and it really was not that fine after all. Observe little children around Christmas, how their anticipation and their expectations are so great. The investment of time, energy and attention is so great, but after the gifts are all unwrapped, there is disappointment. The investment is great. The reward is small. Consider how many times you were disappointed by things that you had hoped would be wonderful and magnificent. Why the disappointment? Because the investment was great and the reward was small. Recall experiences where you made an investment of yourself and there was no reward at all.

PLEASURE

review your own investment in pleasure. Itemize the things that you are attempting to acquire or secure for yourself. Look at the investment. Look at the reward. Ask yourself, "Is this reward worthy of the investment?"

But this is only part of the truth. Much intellectual property is produced only after considerable financial investment, whether it be in the research laboratory or in the graduate education of the scientist using the facility.

Intellectual property is more egalitarian than property in that anyone may obtain it for limited duration, however that is only part of the truth, and in practice it is more likely that most intellectual property is produced only after considerable financial investment.