Sometimes you feel like you need to find something that is sure to succeed. But nothing worth doing has that profile – nothing in life.

- Apr 2025

-

news.stanford.edu news.stanford.edu

-

- Dec 2024

-

www.youtube.com www.youtube.com

-

for - youtube - UAB presentation - Remaining Carbon Budget - Kevin Anderson, 2024 - to - paper - Assessing the size and uncertainty of Remaining Carbon Budget (RCB) - Lamboll et al, 2023

to - paper - Assessing the size and uncertainty of Remaining Carbon Budget (RCB) - Lamboll et al, 2023 - https://hyp.is/0OGiIq-6Ee-xlr9v_TU2ZQ/www.nature.com/articles/s41558-023-01848-5

-

-

-

for - paper - Assessing the size and uncertainty of Remaining Carbon Budget (RCB) - Lamboll et al, 2023 - from - youtube - Climate scientist Kevin Anderson warns: Only 4 years left to stay below 1.5°C without urgent action

from - youtube - Climate scientist Kevin Anderson warns: Only 4 years left to stay below 1.5°C without urgent action - https://hyp.is/u-rKxK-6Ee-TT7OpdMUOTw/www.youtube.com/watch?v=kFDRp-JMf9Q

-

- Jun 2024

-

aworkinglibrary.com aworkinglibrary.com

-

www.belfercenter.org www.belfercenter.org

-

TensionThe ability to see like a data structure afforded us the technology we have today. But it was built for and within a set of societal systems—and stories—that can’t cope with nebulosity. Worse still is the transitional era we’ve entered, in which overwhelming complexity leads more and more people to believe in nothing. That way lies madness. Seeing is a choice, and we need to reclaim that choice. However, we need to see things and do things differently, and build sociotechnical systems that embody this difference.This is best seen through a small example. In our jobs, many of us deal with interpersonal dynamics that sometimes overwhelm the rules. The rules are still there—those that the company operates by and laws that it follows—meaning there are limits to how those interpersonal dynamics can play out. But those rules are rigid and bureaucratic, and most of the time they are irrelevant to what you’re dealing with. People learn to work with and around the rules rather than follow them to the letter. Some of these might be deliberate hacks, ones that are known, and passed down, by an organization’s workers. A work-to-rule strike, or quiet quitting for that matter, is effective at slowing a company to a halt because work is never as routine as schedules, processes, leadership principles, or any other codified rules might allow management to believe.The tension we face is that on an everyday basis, we want things to be simple and certain. But that means ignoring the messiness of reality. And when we delegate that simplicity and certainty to systems—either to institutions or increasingly to software—they feel impersonal and oppressive. People used to say that they felt like large institutions were treating them like a number. For decades, we have literally been numbers in government and corporate data structures. BreakdownAs historian Jill Lepore wrote, we used to be in a world of mystery. Then we began to understand those mysteries and use science to turn them into facts. And then we quantified and operationalized those facts through numbers. We’re currently in a world of data—overwhelming, human-incomprehensible amounts of data—that we use to make predictions even though that data isn’t enough to fully grapple with the complexity of reality.How do we move past this era of breakdown? It’s not by eschewing technology. We need our complex socio-technical systems. We need mental models to make sense of the complexities of our world. But we also need to understand and accept their inherent imperfections. We need to make sure we’re avoiding static and biased patterns—of the sort that a state functionary or a rigid algorithm might produce—while leaving room for the messiness inherent in human interactions. Chapman calls this balance “fluidity,” where society (and really, the tech we use every day) gives us the disparate things we need to be happy while also enabling the complex global society we have today.

-

But that’s not the case for a computer, or a robot, or even a corporate food service, which can’t navigate the intricacies and uncertainties of the real world with the flexibility we expect of a person. And at an even larger scale, our societal systems, whether we’re talking about laws and governments or just the ways our employers expect us to get our jobs done, don’t have that flexibility built into them. We’ve seen repeatedly how breaking corporate or government operations into thousands of disparate, rigid contracts ends in failure.

-

-

docdrop.org docdrop.org

-

Advocating for the great booksidea, then, could mean fighting against anti-intellectualism, antira-tionalism (i.e., the reliance on ideology), and “agnotology.”

definition of agnotology:

Within the sociology of knowledge, agnotology (formerly agnatology) is the study of deliberate, culturally induced ignorance or doubt, typically to sell a product, influence opinion, or win favour, particularly through the publication of inaccurate or misleading scientific data (disinformation). More generally, the term includes the condition where more knowledge of a subject creates greater uncertainty. https://en.wikipedia.org/wiki/Agnotology

-

- Nov 2023

-

www.theguardian.com www.theguardian.com

-

Einer neuen Studie zufolge liegt das CO2 Budget, mit dem sich das 1,5 Grad Ziel mit wenigstens 50% Wahrscheinlichkeit noch erreichen ließe, bei 250 Milliarden Tonnen. Es ist damit nur halb so hoch, wie bisher angenommen. Bei der von den UN vorangetriebenen Halbierung der Emissionen bis 2030 liege die Chance bei maximal 40%. https://www.theguardian.com/environment/2023/oct/30/climate-crisis-carbon-emissions-budget

-

-

www.derstandard.at www.derstandard.at

-

Die Schere zwischen den nötigen Maßnahmen zur Anpassung an die globale Erhitzung und den dafür zur Verfügung gestellten Mitteln geht weiter auf. Der neue Adaptation Gap Report der Vereinten Nationen stellt fest, dass die Kosten für die Anpassung dramatisch steigen. https://www.derstandard.at/story/3000000193529/anpassung-an-klimakrise-hat-sich-verlangsamt-statt-an-fahrt-aufzunehmen

Report: https://www.unep.org/resources/adaptation-gap-report-2023

-

-

wiredvanity.substack.com wiredvanity.substack.com

-

Reflecting on this, I'm reminded of a pattern that has been evident since my days co-running Third Wave with Johannes: the adoption of Uncertainty Coping Strategies. Broadly speaking, these are various behaviors, products, and practices people employ to manage the strains of everyday reality. Our work has consistently identified a spectrum ranging from technological interventions like neuroimplants to the rise in mindfulness services.The staggering contrasts in how different socioeconomic groups address these pressures are well illustrated by the recent New York Times article.

'uncertainty coping strategies' equal living your life I suppose, in the face of the 'strains of everyday reality' since the groups in caves. What is different here wrt Igor and Johannes' work experience and patterns. Just Urbanism (then how is this diff from 18th century?) The complexity of those strains? The inability to withdraw from strains created by others through industrial work practices / social media algo inducement? The sense of looming doom wrt ecocollapse, financial crash etc, systemic threats iw and no agency to individually address some of that? Or is it merely the high end market catering to it, exploiting the stress rather than solving the stressors? What is Igo saying here?

-

- Sep 2023

-

www.washingtonpost.com www.washingtonpost.com

-

This is one of the challenges of being reactive to the public mood, rather than shaping it. Donald Trump, too, launched his first presidential campaign by elevating arguments and rhetoric from right-wing media, but he also shaped what the media was talking about. DeSantis has largely followed the trends, and the trends shift.

While Donald J. Trump seemed to hold say over what was trending and the media was discussing, Philip Bump notices that Ron DeSantis seems to be trailing or perhaps riding the trends rather than leading them.

Is this because he's only tubthumping one or two at a time while Trump floats trial balloons regularly and is pushing half a dozen or more at time?

-

- Aug 2023

-

www.youtube.com www.youtube.com

-

when we step into uncertainty, our bodies respond physiologically and mentally.

- for: transition, uncertainty, uncertainty - neuroscience, ingroup, outgroup, letting go, lifetime student

- paraphrase

- Uncertainty brings

- immune system deterioration

- brain cells wither and even die

- creativity and intelligence decrease

- We often go from fear to anger because fear is a state of certainty.

- We become morally judgmental, an extreme version of oneself.

- conservatives become ultra-conservative

- liberals become ultra liberal.

- because we retreat to a place of safety and familiarity.

- The problem is that the world changes.

- Since we have to adapt or die, if we want to shift from A to B,

- the first step is not B.

- the first step is to go from A to not A

- to let go of our biases and assumptions;

- to step into the very place that our brain evolved to avoid;

- to step into the place of the unknown.

- to step into a liminal space

- Uncertainty brings

- comment

- Uncertainty is uncomfortable

- and can drive us into our familiar, accepted, insular ingroup

- In other words, lead to greater social polarization.

- Adaptation requires us to step into the unknown.

- Big changes in our lives therefore require us to go

- from the familiar and comfortable space,

- to the unfamiliar and uncomfortable

- movement away from our comfort zone, as is happening as the polycrisis we face gains traction.

-

- Jul 2023

-

www.academia.edu www.academia.edu

-

“Biaya paling mahal hidup di Indonesia adalah biaya ketidakpastian (uncertainties),”

-

- May 2023

-

en.wikipedia.org en.wikipedia.org

-

The Hawthorne effect is a type of human behavior reactivity

explore relationships here with body doubling, observer effect (physics), and Heisenberg's uncertainty principle...

-

- Jan 2023

-

forum.zettelkasten.de forum.zettelkasten.de

-

Note 9/8j says - "There is a note in the Zettelkasten that contains the argument that refutes the claims on every other note. But this note disappears as soon as one opens the Zettelkasten. I.e. it appropriates a different number, changes position (or: disguises itself) and is then not to be found. A joker." Is he talking about some hypothetical note? What did he mean by disappearing? Can someone please shed some light on what he really meant?

On the Jokerzettel

9/8j Im Zettelkasten ist ein Zettel, der das Argument enthält, das die Behauptungen auf allen anderen Zetteln widerlegt.

Aber dieser Zettel verschwindet, sobald man den Zettelkasten aufzieht.

D.h. er nimmt eine andere Nummer an, verstellt sich und ist dann nicht zu finden.

Ein Joker.

—Niklas Luhmann, ZK II: Zettel 9/8j

Translation:

9/8j In the slip box is a slip containing the argument that refutes the claims on all the other slips. But this slip disappears as soon as you open the slip box. That is, he assumes a different number, disguises himself and then cannot be found. A joker.

Many have asked about the meaning of this jokerzettel over the past several years. Here's my slightly extended interpretation, based on my own practice with thousands of cards, about what Luhmann meant:

Imagine you've spent your life making and collecting notes and ideas and placing them lovingly on index cards. You've made tens of thousands and they're a major part of your daily workflow and support your life's work. They define you and how you think. You agree with Friedrich Nietzsche's concession to Heinrich Köselitz that “You are right — our writing tools take part in the forming of our thoughts.” Your time is alive with McLuhan's idea that "The medium is the message." or in which his friend John Culkin said, "We shape our tools and thereafter they shape us."

Eventually you're going to worry about accidentally throwing your cards away, people stealing or copying them, fires (oh! the fires), floods, or other natural disasters. You don't have the ability to do digital back ups yet. You ask yourself, can I truly trust my spouse not to destroy them?,What about accidents like dropping them all over the floor and needing to reorganize them or worse, the ghost in the machine should rear its head?

You'll fear the worst, but the worst only grows logarithmically in proportion to your collection.

Eventually you pass on opportunities elsewhere because you're worried about moving your ever-growing collection. What if the war should obliterate your work? Maybe you should take them into the war with you, because you can't bear to be apart?

If you grow up at a time when Schrodinger's cat is in the zeitgeist, you're definitely going to have nightmares that what's written on your cards could horrifyingly change every time you look at them. Worse, knowing about the Heisenberg Uncertainly Principle, you're deathly afraid that there might be cards, like electrons, which are always changing position in ways you'll never be able to know or predict.

As a systems theorist, you view your own note taking system as a input/output machine. Then you see Claude Shannon's "useless machine" (based on an idea of Marvin Minsky) whose only function is to switch itself off. You become horrified with the idea that the knowledge machine you've painstakingly built and have documented the ways it acts as an independent thought partner may somehow become self-aware and shut itself off!?!

https://www.youtube.com/watch?v=gNa9v8Z7Rac

And worst of all, on top of all this, all your hard work, effort, and untold hours of sweat creating thousands of cards will be wiped away by a potential unknowable single bit of information on a lone, malicious card and your only recourse is suicide, the unfortunate victim of dataism.

Of course, if you somehow manage to overcome the hurdle of suicidal thoughts, and your collection keeps growing without bound, then you're sure to die in a torrential whirlwind avalanche of information and cards, literally done in by information overload.

But, not wishing to admit any of this, much less all of this, you imagine a simple trickster, a joker, something silly. You write it down on yet another card and you file it away into the box, linked only to the card in front of it, the end of a short line of cards with nothing following it, because what could follow it? Put it out of your mind and hope your fears disappear away with it, lost in your box like the jokerzettel you imagined. You do this with a self-assured confidence that this way of making sense of the world works well for you, and you settle back into the methodical work of reading and writing, intent on making your next thousands of cards.

Tags

- Lila

- dataism

- Niklas Luhmann's zettelkasten

- Werner Heisenberg

- useless machines

- Schrödinger's cat

- Niklas Luhmann

- note collection loss and damage

- Heisenberg Uncertainty Principle

- fear uncertainty and doubt

- death by zettelkasten

- jokerzettel

- Ghostbusters

- Erwin Schrödinger

- Claude Shannon

- ghost in the machine

- fears

Annotators

URL

-

- Dec 2022

-

link.springer.com link.springer.com

-

We analyzed URLs cited in Twitter messages before and after the temporary interruption of the vaccine development on September 9, 2020 to investigate the presence of low credibility and malicious information. We show that the halt of the AstraZeneca clinical trials prompted tweets that cast doubt, fear and vaccine opposition. We discovered a strong presence of URLs from low credibility or malicious websites, as classified by independent fact-checking organizations or identified by web hosting infrastructure features. Moreover, we identified what appears to be coordinated operations to artificially promote some of these URLs hosted on malicious websites.

-

-

www.nature.com www.nature.com

-

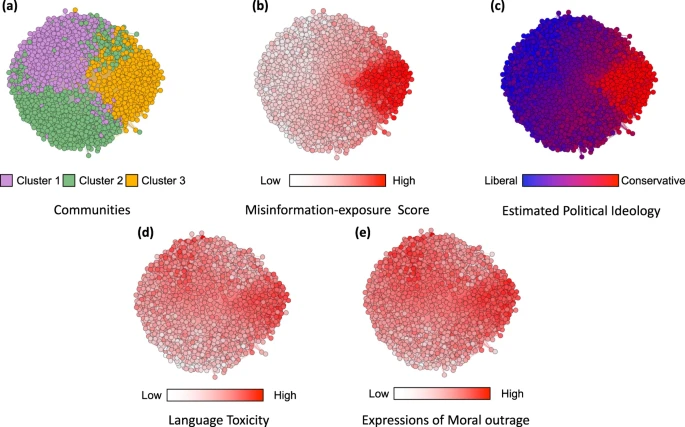

We found that users who followed elites who made more false or inaccurate statements themselves shared news from lower-quality news outlets (as judged by both fact-checkers and politically-balanced crowds of laypeople), used more toxic language, and expressed more moral outrage.

Elite mis and disinformation sharers have a negative effect on followers.

-

In the co-share network, a cluster of websites shared more by conservatives is also shared more by users with higher misinformation exposure scores.

Nodes represent website domains shared by at least 20 users in our dataset and edges are weighted based on common users who shared them. a Separate colors represent different clusters of websites determined using community-detection algorithms29. b The intensity of the color of each node shows the average misinformation-exposure score of users who shared the website domain (darker = higher PolitiFact score). c Nodes’ color represents the average estimated ideology of the users who shared the website domain (red: conservative, blue: liberal). d The intensity of the color of each node shows the average use of language toxicity by users who shared the website domain (darker = higher use of toxic language). e The intensity of the color of each node shows the average expression of moral outrage by users who shared the website domain (darker = higher expression of moral outrage). Nodes are positioned using directed-force layout on the weighted network.

-

We found that misinformation-exposure scores are significantly positively related to language toxicity (Fig. 3a; b = 0.129, 95% CI = [0.098, 0.159], SE = 0.015, t (4121) = 8.323, p < 0.001; b = 0.319, 95% CI = [0.274, 0.365], SE = 0.023, t (4106) = 13.747, p < 0.001 when controlling for estimated ideology) and expressions of moral outrage (Fig. 3b; b = 0.107, 95% CI = [0.076, 0.137], SE = 0.015, t (4143) = 14.243, p < 0.001; b = 0.329, 95% CI = [0.283,0.374], SE = 0.023, t (4128) = 14.243, p < 0.001 when controlling for estimated ideology). See Supplementary Tables 1, 2 for full regression tables and Supplementary Tables 3–6 for the robustness of our results.

-

-

www.nature.com www.nature.com

-

The style is one that is now widely recognized as a tool of sowing doubt: the author just asked ‘reasonable’ questions, without making any evidence-based conclusions.Who is the audience of this story and who could potentially be targeted by such content? As Bratich argued, 9/11 represents a prototypical case of ‘national dissensus’ among American individuals, and an apparently legitimate case for raising concerns about the transparency of the US authorities13. It is indicative that whoever designed the launch of RT US knew how polarizing it would be to ask questions about the most painful part of the recent past.

-

-

www.nature.com www.nature.com

-

In the Irish sample, the combined vaccine hesitant and resistant group differed most pronouncedly from the vaccine acceptance group on the following psychological variables: lower levels of trust in scientists (d = 0.51), health care professionals (d = 0.45), and the state (d = 0.31); more negative attitudes toward migrants (d’s ranged from 0.27 to 0.29); lower cognitive reflection (d = 0.25); lower levels of altruism (d’s ranged from 0.17 to 0.24); higher levels of social dominance (d = 0.22) and authoritarianism (d = 0.14); higher levels of conspiratorial (d = 0.21) and religious (d = 0.20) beliefs; lower levels of the personality trait agreeableness (d = 0.15); and higher levels of internal locus of control (d = 0.14).

-

-

-

The only negative to this method is that it may not ALWAYS work. If the data is faulty, or the link is inaccurately provided by the sender, Gmail won’t be able to recognise and include the unsubscribe button in Gmail.

-

You may find this link isn’t available straight away, after a few emails one should appear, this is a common technique with mailing list providers.

-

-

zephoria.medium.com zephoria.medium.com

-

I often think back to MySpace’s downfall. In 2007, I penned a controversial blog post noting a division that was forming as teenagers self-segregated based on race and class in the US, splitting themselves between Facebook and MySpace. A few years later, I noted the role of the news media in this division, highlighting how media coverage about MySpace as scary, dangerous, and full of pedophiles (regardless of empirical evidence) helped make this division possible. The news media played a role in delegitimizing MySpace (aided and abetted by a team at Facebook, which was directly benefiting from this delegitimization work).

danah boyd argued in two separate pieces that teenagers self-segregated between MySpace and Facebook based on race and class and that the news media coverage of social media created fear, uncertainty, and doubt which fueled the split.

-

- Nov 2022

-

threadreaderapp.com threadreaderapp.com

-

Trope, trope, trope, strung into a Gish Gallop.

One of the issues we see in the Sunday morning news analysis shows (Meet the Press, Face the Nation, et al.) is that there is usually a large amount of context collapse mixed with lack of general knowledge about the topics at hand compounded with large doses of Gish Gallop and F.U.D. (fear, uncertainty, and doubt).

-

-

wexler.free.fr wexler.free.fr

-

Amos Tversky's famous "The Hot Hand in Basketball: On the Misperception of Random Sequences".

-

- Oct 2022

-

www.theatlantic.com www.theatlantic.com

-

Today, the people in politics who most often invoke the name of Jesus for their political causes tend to be the most merciless and judgmental, the most consumed by rage and fear and vengeance. They hate their enemies, and they seem to want to make more of them. They claim allegiance to the truth and yet they have embraced, even unwittingly, lies. They have inverted biblical ethics in the name of biblical ethics.

-

-

www.carproclub.com www.carproclub.com

-

Your Alternator Is Not A ChargerYes, you read that right. An alternator is designed to MAINTAIN your car battery, not recharge it from a deeply discharged state. Its designed to run at only 35-50% of its fully rated output. When you use your cars alternator to recharge a dead battery, you force it to run at nearly 100% of its rated capacity and that overheats the alternator and dramatically shortens its life.

This was the opinion also of https://hyp.is/YNQwwlF0Ee206UcS3HYLnA/www.reddit.com/r/Cartalk/comments/aoks7b/how_much_idling_needed_after_jump_start_to/

but are they misinformed?

-

-

github.com github.com

-

But this sounds like spreading fear and doubt when the Ruby parser has no such concepts :) {} always binds tightly to the call right next to it. This block {} will never go to using, unless it's rewritten as do ... end.

-

- Sep 2022

-

www.scientificamerican.com www.scientificamerican.com

-

We observed an overall increase in the amount of negative information as it passed along the chain—known as the social amplification of risk.

Could this be linked to my FUD thesis about decisions based on possibilities rather than realities?

-

-

developer.mozilla.org developer.mozilla.org

-

The request might or might not eventually be acted upon, as it might be disallowed when processing actually takes place.

-

- Aug 2022

-

www.theguardian.com www.theguardian.com

-

Sridhar, D. (2021, September 23). ‘I Know Who Caused Covid-19’ review – the global blame game. The Guardian. https://www.theguardian.com/books/2021/sep/23/i-know-who-caused-covid-19-review-the-global-blame-game

-

-

www.economist.com www.economist.com

-

The pandemic’s true death toll. (2021, November 1). The Economist. https://www.economist.com/graphic-detail/coronavirus-excess-deaths-estimates

-

-

www.sciencedirect.com www.sciencedirect.com

-

McKee, M., Altmann, D., Costello, A., Friston, K., Haque, Z., Khunti, K., Michie, S., Oni, T., Pagel, C., Pillay, D., Reicher, S., Salisbury, H., Scally, G., Yates, K., Bauld, L., Bear, L., Drury, J., Parker, M., Phoenix, A., … West, R. (2022). Open science communication: The first year of the UK’s Independent Scientific Advisory Group for Emergencies. Health Policy. https://doi.org/10.1016/j.healthpol.2022.01.006

-

-

www.bps.org.uk www.bps.org.uk

-

Decision-making in uncertainty | BPS. (n.d.). Retrieved November 22, 2021, from https://www.bps.org.uk/events/decision-making-uncertainty

-

-

gidmk.medium.com gidmk.medium.com

-

Nerd, G. M.-K. H. (2022, February 25). The Jury is Still Out on Ivermectin. Medium. https://gidmk.medium.com/the-jury-is-still-out-on-ivermectin-7d0a1895549

-

- Jul 2022

-

-

that's something that insect with a six-legged version is now it's the whole super organism oh well the ant colony is society that whole frame is actually the shadow of 01:18:52 what the evolutionary reality is which is that the ant colony is an organism not a super organism and the ants are tissues and so which level we prioritize or do we say no there's no a priori level ant is just i'm not even 01:19:05 gonna say there's anything out there called ants it's it's you how you're thinking about it or do we get lost or are we going to find a ladder in that multi-scale yeah well the latter is you know the 01:19:17 latter is active inference because it doesn't say active inference doesn't say make a make an internal model of the world that is accurate that actually accurately captures all the all the 01:19:30 details of the world of the universe that's not the point that's not what the mind does that's not the point the point is to act under uncertainty 01:19:41 given some useful model of the world act under uncertainty so that your fitness score improves and by fitness score here we essentially mean you know and anticipated uncertainty so i i would 01:19:55 very much like to be have some certainty that i'm going to be alive tomorrow and if it's freezing outside and i don't have a coat on uh you know that that becomes iffy so uh i'm going to be happy 01:20:06 if i'm going to be i'm going to go find a coat because it is going to reduce my uncertainty about survival over the next 24 hours but you can expand that you know outward right we we need to act the all organisms are acting under 01:20:19 uncertainty and and we can think about that as we can think about that um we can think from that perspective as a society of what are we doing and how do we measure 01:20:31 success well we're measuring success by acting under uncertainty and then re and then paying attention to what happens and then acting the same or differently or you know some other way or somehow some were 01:20:45 then choosing to act again in this cycle of act uh you know act uh process act process act process you know model act model act model that reminds me of course of the ooda 01:20:57 observe orient side act model and other sort of cyclic models of action and perception and then i would say that active inference provides a few nice little benefits over other phrasings of action and perception 01:21:10 qualitative and philosophical ones like inactivism as well as quantitative ones like cybernetics and other kinds of control theories so i totally agree this

An organism acts under uncertainty to reduce it to meet its objective.

Tags

Annotators

URL

-

- Jun 2022

-

Local file Local file

-

This fundamental tension—between quality and quantity—is atension we share as knowledge workers. We also must producework to an extremely high standard, and we must do it fast,continuously, all year long. We are like sprinters who are also tryingto run a marathon.

Do we? Really? This definitely needs reframing and books like this that play on these sorts of fears are both partially responsible, but are also preying on an atmosphere which they're propagating.

This is the sort of sad thing that a productivity guru would say...

-

-

globalecoguy.org globalecoguy.org

-

It’s as if we need the gravitational pull of both worlds to keep us on track, locked on a good and righteous path. Without both worlds pulling on us, we would crash into one, or simply lose our way, hurtling through the universe on our own, intersecting nothing, helping no one.

As neuroscietist Beau Lotto points out, the Anthropocene is creating greater and greater uncertainty and unpredictability, but the one human trait evolution has created to help us deal with this is the sense of awe. See my annotation on Beau Lotto's beautiful TED Talk: How we experience awe and why it matters https://hyp.is/go?url=http%3A%2F%2Fdocdrop.org%2Fvideo%2F17D5SrgBE6g%2F&group=world

In short, the sacred is the antidote to the increase in uncertainty and unpredictability as we enter into the space of the Anthropocene. Awe can be the leverage point to the ultimate leverage point for system change that Donella Meadows pointed out many years ago- it can lead to rapid shift in paradigms, worldviews and value systems needed to shift the system.

-

- Apr 2022

-

twitter.com twitter.com

-

Dr. Deepti Gurdasani [@dgurdasani1]. (2021, December 14). So those critiquing others for being too certain (I get subtweeted a lot for this)- Am I certain about the exact impact of omicron in the UK? Not at all Am I certain it’ll be high impact? Quite Am I certain we should act now? Absolutely [Tweet]. Twitter. https://twitter.com/dgurdasani1/status/1470828234480701443

-

-

twitter.com twitter.com

-

Julia Raifman. (2021, July 25). Policymakers are pointing fingers at “the unvaccinated” What if they gave them a hand instead? - Bring vax & food to workplaces, schools, homes -Fund local doctors, including pediatricians, to call patients & deliver vax—Learn from success of Indian Health Service approach [Tweet]. @JuliaRaifman. https://twitter.com/JuliaRaifman/status/1419288641885593604

-

- Feb 2022

-

www.cbsnews.com www.cbsnews.com

-

A cause of America’s labor shortage: Millions with long COVID. (n.d.). Retrieved February 2, 2022, from https://www.cbsnews.com/news/long-covid-labor-market-missing-workers/

-

- Jan 2022

-

en.wikipedia.org en.wikipedia.org

-

Goodhart's law is an adage often stated as "When a measure becomes a target, it ceases to be a good measure".[1] It is named after British economist Charles Goodhart, who advanced the idea in a 1975 article on monetary policy in the United Kingdom:[2][3] .mw-parser-output .templatequote{overflow:hidden;margin:1em 0;padding:0 40px}.mw-parser-output .templatequote .templatequotecite{line-height:1.5em;text-align:left;padding-left:1.6em;margin-top:0}Any observed statistical regularity will tend to collapse once pressure is placed upon it for control purposes.

We measure what we find important.

Measures can and often become self-fulfilling targets. (read: Rankings and Reactivity by W. Espeland and M. Sauder https://www.stmarys-ca.edu/sites/default/files/attachments/files/rankings-and-reactivity-2007.pdf)

When a measure becomes a target it ceases to be a good measure.

So why measure?

Is observation and measurement part of a larger complex process which isn't finished until the process itself is finished?

This seems related to the measurement problem in quantum mechanics, Schrödinger's cat, the Heisenberg uncertainty principle, and the observer effect).

-

- Dec 2021

-

-

Musicals, plays and pantos cancel shows after Covid-19 outbreaks. (2021, December 14). BBC News. https://www.bbc.com/news/entertainment-arts-59638954

-

-

twitter.com twitter.comTwitter1

-

Kristian G. Andersen on Twitter. (n.d.). Twitter. Retrieved 3 December 2021, from https://twitter.com/K_G_Andersen/status/1465822536629821442

-

- Nov 2021

-

www.theguardian.com www.theguardian.com

-

Wiseman, E. (2021, October 17). The dark side of wellness: The overlap between spiritual thinking and far-right conspiracies. The Observer. https://www.theguardian.com/lifeandstyle/2021/oct/17/eva-wiseman-conspirituality-the-dark-side-of-wellness-how-it-all-got-so-toxic

Tags

- anti-vaccine

- science

- pseudoscience

- conspirituality

- wellbeing

- psychology

- uncertainty

- lang:en

- spirituality

- health

- mental health

- online community

- conspiracy theory

- trust

- QAnon

- disinformation

- influencer

- is:news

- misinformation

- worldview

- wellness industry

- right wing

- Center for Countering Digital Hate

- ideology

- infodemic

- social media

- debunking

- policy

- wellness

Annotators

URL

-

-

-

Desforges, M., Gurdasani, D., Hamdy, A., & Leonardi, A. J. (2021). Uncertainty around the Long-Term Implications of COVID-19. Pathogens, 10(10), 1267. https://doi.org/10.3390/pathogens10101267

-

- Oct 2021

-

www.cambridge.org www.cambridge.org

-

Lagnado, D. A. (2022). Explaining the evidence: How the mind investigates the world. Cambridge University Press.

-

-

twitter.com twitter.com

-

Seth Trueger. (2021, September 14). Https://t.co/LFZ3xWkYYY [Tweet]. @MDaware. https://twitter.com/MDaware/status/1437780952890191878

-

-

-

Covid-19: ‘Vaccine misinformation a dilemma for young people’. (2021, September 19). BBC News. https://www.bbc.com/news/uk-northern-ireland-58616080

-

-

www.nature.com www.nature.com

-

Telenti, A., Arvin, A., Corey, L., Corti, D., Diamond, M. S., García-Sastre, A., Garry, R. F., Holmes, E. C., Pang, P., & Virgin, H. W. (2021). After the pandemic: perspectives on the future trajectory of COVID-19. Nature, 1–14. https://doi.org/10.1038/s41586-021-03792-w

-

- Sep 2021

-

-

Shu, J., Ochsner, K. N., & Phelps, E. A. (2021). The Impact of Intolerance of Uncertainty on Reappraisal and Suppression. PsyArXiv. https://doi.org/10.31234/osf.io/fsnvy

-

-

www.gavi.org www.gavi.org

-

Josh Michaud. “Over the next 2 Months COVAX Expects to Have Access to Almost Twice as Many Covid-19 Vaccine Doses as It Did over the First 8 Months of This Year. Https://Gavi.Org/Sites/Default/Files/Covid/Covax/COVAX-Supply-Forecast.Pdf Https://T.Co/JBtGYXFTwc.” Tweet. @joshmich (blog), September 2, 2021. https://twitter.com/joshmich/status/1433462474544660484.

-

- Aug 2021

-

royalsocietypublishing.org royalsocietypublishing.org

-

we find that fixing fossil ages to the midpoint or a random point drawn from within the stratigraphic age range leads to biases in divergence time estimates, while sampling fossil ages leads to estimates that are similar to inferences that employ the correct ages of fossils. Second, we show a comparison using an empirical dataset of extant and fossil cetaceans, which confirms that different methods of handling fossil age uncertainty lead to large differences in estimated node ages

dealing with uncertainties carefully actually matters

-

-

psyarxiv.com psyarxiv.com

-

Zarzeczna, N., Hanel, P. H. P., Rutjens, B., Bono, S. A., Chen, Y.-H., & Haddock, G. (2021). Scientists, speak up! Source impacts trust in and intentions to comply with health advice cross-culturally. PsyArXiv. https://doi.org/10.31234/osf.io/279yg

-

-

kerkour.com kerkour.com

-

Stop trying to connect all the dots ahead of time. Embrace uncertainty and start doing. “You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something — your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life." - Steve Jobs

decent write up, solid concluding quote.

-

-

blog.logrocket.com blog.logrocket.com

-

Before you go like “Wow!!!”, understand that the packages highlighted above take a lot into consideration when detecting timezones. This makes them slightly more accurate than Intl API alone.

What exactly does moment do for us, then, that

TimeFormat().resolvedOptions().timeZone;doesn't do? Name one example where it is more accurate.

-

-

www.cnn.com www.cnn.com

-

Covid-19: New poll shows why some vaccine-hesitant Americans decided to get the shot—CNNPolitics. (n.d.). Retrieved August 2, 2021, from https://edition.cnn.com/2021/07/13/politics/poll-covid-19-vaccine-decision/index.html

-

-

www.ncbi.nlm.nih.gov www.ncbi.nlm.nih.gov

-

Smith, M. J., Ahmad, A., Arawi, T., Dawson, A., Emanuel, E. J., Garani-Papadatos, T., Ghimire, P., Iliyasu, Z., Lei, R., Mastroleo, I., Mathur, R., Okeibunor, J., Parker, M., Saenz, C., Thomé, B., Upshur, R. E. G., & Voo, T. C. (2021). Top five ethical lessons of COVID-19 that the world must learn. Wellcome Open Research, 6, 17. https://doi.org/10.12688/wellcomeopenres.16568.1

-

- Jul 2021

-

-

Padilla, L., Hosseinpour, H., Fygenson, R., Howell, J., Chunara, R., & Bertini, E. (2021). Effects of COVID-19 Uncertainty Visualizations on Novice Risk Estimates. PsyArXiv. https://doi.org/10.31234/osf.io/6axc7

-

- Jun 2021

-

252f2edd-1c8b-49f5-9bb2-cb57bb47e4ba.filesusr.com 252f2edd-1c8b-49f5-9bb2-cb57bb47e4ba.filesusr.com

-

The Anti-Vaxx Playbook | Center for Countering Digital Hate. (n.d.). Retrieved June 26, 2021, from https://www.counterhate.com/playbook

-

- May 2021

-

80000hours.org 80000hours.org

-

Career decision making involves so much uncertainty that it’s easy to feel paralysed. Instead, make some hypotheses about which option is best, then identify key uncertainties: what information would most change your best guess?

We tend to think that uncertainties can't be weighted in our decision-making, but we bet on uncertainties all the time. Rather than throw your hands up and say, "I don't have enough information to make a call", how can we think deliberately about what information would reduce the uncertainty?

-

think of your career as a series of experiments designed to help you learn about yourself and test out potentially great longer-term paths

I wonder if there's a connection here to Duke, A. (2019). Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts. Portfolio.

I haven't read the book but it's on my list.

-

-

www.theguardian.com www.theguardian.com

-

the Guardian. “How Good Are We at Predicting the Pandemic? | David Spiegelhalter & Anthony Masters,” May 9, 2021. http://www.theguardian.com/theobserver/commentisfree/2021/may/09/how-good-are-we-at-predicting-pandemic.

-

-

arxiv.org arxiv.org

-

Broniatowski, D. A., Kerchner, D., Farooq, F., Huang, X., Jamison, A. M., Dredze, M., & Quinn, S. C. (2020). The COVID-19 Social Media Infodemic Reflects Uncertainty and State-Sponsored Propaganda. ArXiv:2007.09682 [Physics]. http://arxiv.org/abs/2007.09682

-

- Mar 2021

-

twitter.com twitter.com

-

The BMJ on Twitter. (n.d.). Twitter. Retrieved 5 March 2021, from https://twitter.com/bmj_latest/status/1324962326127251457

-

- Feb 2021

-

www.scientificamerican.com www.scientificamerican.com

-

McKenna, S. (n.d.). COVID Models Show How to Avoid Future Lockdowns. Scientific American. Retrieved 26 February 2021, from https://www.scientificamerican.com/article/covid-models-show-how-to-avoid-future-lockdowns/

-

-

twitter.com twitter.com

-

ReconfigBehSci on Twitter: ‘RT @DrBrookeRogers: Universities and colleges face Covid funding shortfalls https://t.co/v2s0dVETBa’ / Twitter. (n.d.). Retrieved 24 February 2021, from https://twitter.com/SciBeh/status/1323575049425768448

-

-

www.bbc.co.uk www.bbc.co.uk

-

Universities and colleges face Covid funding shortfalls. (2020, November 3). BBC News. https://www.bbc.com/news/education-54780790

-

-

en.wikipedia.org en.wikipedia.org

-

In object-oriented programming, information hiding (by way of nesting of types) reduces software development risk by shifting the code's dependency on an uncertain implementation (design decision) onto a well-defined interface. Clients of the interface perform operations purely through it so if the implementation changes, the clients do not have to change.

-

- Dec 2020

-

www.nature.com www.nature.com

-

Ledford, H. (2020). Oxford COVID-vaccine paper highlights lingering unknowns about results. Nature. https://doi.org/10.1038/d41586-020-03504-w

-

- Oct 2020

-

stackoverflow.com stackoverflow.com

-

If you have a better/simpler/"more official" solution, I'd still love to see it!

The "official" solution is to use submitErrors (see Erik's answer).

-

-

en.wikipedia.org en.wikipedia.org

-

The Y-intercept of the SML is equal to the risk-free interest rate. The slope of the SML is equal to the market risk premium and reflects the risk return tradeoff at a given time: S M L : E ( R i ) = R f + β i [ E ( R M ) − R f ] {\displaystyle \mathrm {SML} :E(R_{i})=R_{f}+\beta _{i}[E(R_{M})-R_{f}]\,} where: E(Ri) is an expected return on security E(RM) is an expected return on market portfolio M β is a nondiversifiable or systematic risk RM is a market rate of return Rf is a risk-free rate

This is one statement of the key relationship.

The point is that the market will have a single tradeoff between unavoidable (nondiversifiable) risk and return.

Asset's returns must reflect this, according to the theory. Their prices will be bid up (or down), until this is the case ... the 'arbitrage' process.

Why? Because (assuming borrowing/lending at a risk free rate) *any investor can achieve a particular return for a given risk level simply by buying the 'diversified market basket' and leveraging this (for more risk) or investing the remainder in the risk free-asseet (for less risk). (And she can do no better than this.)

-

This abnormal extra return above the market's return at a given level of risk is what is called the alpha.

this is why you here the stock-touts bragging about their 'alpha'

-

-

en.wikipedia.org en.wikipedia.org

-

Capital asset pricing model

please read this article

-

quantity beta (β)

You hear about this 'beta' all the time as the measure of 'the correlation of the risk of an asset with the representative market basket'...

but confusingly, \(\beta\) is used to represent the slope of the expected return of an asset as this risk increases.

-

-

en.wikipedia.org en.wikipedia.org

-

If the fraction q {\displaystyle q} of a one-unit (e.g. one-million-dollar) portfolio is placed in asset X and the fraction 1 − q {\displaystyle 1-q} is placed in Y, the stochastic portfolio return is q x + ( 1 − q ) y {\displaystyle qx+(1-q)y} . If x {\displaystyle x} and y {\displaystyle y} are uncorrelated, the variance of portfolio return is var ( q x + ( 1 − q ) y ) = q 2 σ x 2 + ( 1 − q ) 2 σ y 2 {\displaystyle {\text{var}}(qx+(1-q)y)=q^{2}\sigma _{x}^{2}+(1-q)^{2}\sigma _{y}^{2}} . The variance-minimizing value of q {\displaystyle q} is q = σ y 2 / [ σ x 2 + σ y 2 ] {\displaystyle q=\sigma _{y}^{2}/[\sigma _{x}^{2}+\sigma _{y}^{2}]} , which is strictly between 0 {\displaystyle 0} and 1 {\displaystyle 1} . Using this value of q {\displaystyle q} in the expression for the variance of portfolio return gives the latter as σ x 2 σ y 2 / [ σ x 2 + σ y 2 ] {\displaystyle \sigma _{x}^{2}\sigma _{y}^{2}/[\sigma _{x}^{2}+\sigma _{y}^{2}]} , which is less than what it would be at either of the undiversified values q = 1 {\displaystyle q=1} and q = 0 {\displaystyle q=0} (which respectively give portfolio return variance of σ x 2 {\displaystyle \sigma _{x}^{2}} and σ y 2 {\displaystyle \sigma _{y}^{2}} ). Note that the favorable effect of diversification on portfolio variance would be enhanced if x {\displaystyle x} and y {\displaystyle y} were negatively correlated but diminished (though not eliminated) if they were positively correlated.

Key building block formulae.

Start with 'what happens to the variance when we combine two assets (uncorrelated with same expected return)'

What are the variance minimizing shares and what is the resulting variance of the portfolio.

-

Similarly, a 1985 book reported that most value from diversification comes from the first 15 or 20 different stocks in a portfolio.[6]

the conventional wisdom is that there are sharply diminishing returns to this diversification

-

-

www.bmj.com www.bmj.com

-

Smith, G. D., Blastland, M., & Munafò, M. (2020). Covid-19’s known unknowns. BMJ, 371. https://doi.org/10.1136/bmj.m3979

-

-

www.thelancet.com www.thelancet.com

-

Brown, R. C. H., Kelly, D., Wilkinson, D., & Savulescu, J. (2020). The scientific and ethical feasibility of immunity passports. The Lancet Infectious Diseases, 0(0). https://doi.org/10.1016/S1473-3099(20)30766-0

-

-

www.agileconnection.com www.agileconnection.com

-

This balancing act needs to take into account project complexity (size, distribution, etc.), uncertainty (risk, innovation need, etc.), and the cost of change at the project level and for each major component.

-

-

dylanvann.com dylanvann.com

-

Disclaimer: I’m new to Svelte so this isn’t so much a recommendation as it is a “I guess this is a way to do it 🤷♂️”

-

-

covid-19.iza.org covid-19.iza.org

-

COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved October 11, 2020, from https://covid-19.iza.org/publications/dp13632/

-

-

covid-19.iza.org covid-19.iza.org

-

COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved October 10, 2020, from https://covid-19.iza.org/publications/dp13569/

-

-

www.pewresearch.org www.pewresearch.org

-

NW, 1615 L. St, Suite 800Washington, & Inquiries, D. 20036USA202-419-4300 | M.-857-8562 | F.-419-4372 | M. (2020, September 17). U.S. Public Now Divided Over Whether To Get COVID-19 Vaccine. Pew Research Center Science & Society. https://www.pewresearch.org/science/2020/09/17/u-s-public-now-divided-over-whether-to-get-covid-19-vaccine/

-

- Sep 2020

-

www.theatlantic.com www.theatlantic.com

-

The challenge is to find a way to live with uncertainty,

Finding a way to be okay with uncertainty in life is a challenge for many people. I struggle with this as well. But over the last few months I have found various ways to cope with the anxiety caused by uncertainty. Because the world we live in today is full of uncertainties.

-

-

psyarxiv.com psyarxiv.com

-

Haas, I. J., Baker, M., & Gonzalez, F. (2020). Political Uncertainty Moderates Neural Evaluation of Incongruent Policy Positions. https://doi.org/10.31234/osf.io/bmr59

-

-

www.scotsman.com www.scotsman.com

-

Beware comforting lies about a “herd immunity” Covid-19 strategy. Here’s why it’s dangerous – Professor Devi Sridhar. (n.d.). Retrieved September 25, 2020, from https://www.scotsman.com/news/opinion/columnists/covid-19-herd-immunity-strategy-flawed-until-we-have-coronavirus-vaccine-professor-devi-sridhar-2981017

Tags

- antibody

- epidemiology

- is:news

- uncertainty

- lang:en

- vaccine

- COVID-19

- herd immunity

- safety

- protection

- government response

- strategy

- prediction

Annotators

URL

-

-

www.thelancet.com www.thelancet.com

-

Houlihan, C. F., & Beale, R. (2020). The complexities of SARS-CoV-2 serology. The Lancet Infectious Diseases, 0(0). https://doi.org/10.1016/S1473-3099(20)30699-X

-

-

osf.io osf.io

-

Hennessy, E. A., Acabchuk, R., Arnold, P. A., Dunn, A. G., Foo, Y. Z., Johnson, B. T., Geange, S. R., Haddaway, N. R., Nakagawa, S., Mapanga, W., Mengersen, K., Page, M. J., Sánchez-Tójar, A., Welch, V., & McGuinness, L. A. (2020). Ensuring Prevention Science Research is Synthesis-Ready for Immediate and Lasting Scientific Impact [Preprint]. MetaArXiv. https://doi.org/10.31222/osf.io/ptg9j

-

-

ncrc.jhsph.edu ncrc.jhsph.edu

-

The Contagion Externality of a Superspreading Event: The Sturgis Motorcycle Rally and COVID-19 | NCRC. (2020, September 3). 2019 Novel Coronavirus Research Compendium (NCRC). https://ncrc.jhsph.edu/research/the-contagion-externality-of-a-superspreading-event-the-sturgis-motorcycle-rally-and-covid-19/

-

-

-

Thomas, D., & Giles, C. (2020, September 14). Cities count cost of lasting exodus from offices. https://www.ft.com/content/203cc83c-72b0-49c9-bea5-6fb38735a8fc

-

-

twitter.com twitter.com

-

(((Howard Forman))) on Twitter. (n.d.). Twitter. Retrieved September 16, 2020, from https://twitter.com/thehowie/status/1305232493071736834

-

-

pmc.ncbi.nlm.nih.gov pmc.ncbi.nlm.nih.gov

-

Siemieniuk, R. A., Bartoszko, J. J., Ge, L., Zeraatkar, D., Izcovich, A., Kum, E., Pardo-Hernandez, H., Rochwerg, B., Lamontagne, F., Han, M. A., Liu, Q., Agarwal, A., Agoritsas, T., Chu, D. K., Couban, R., Darzi, A., Devji, T., Fang, B., Fang, C., … Brignardello-Petersen, R. (2020). Drug treatments for covid-19: Living systematic review and network meta-analysis. BMJ, 370. https://doi.org/10.1136/bmj.m2980

-

-

www.reuters.com www.reuters.com

-

Exclusive: In Russia, a black market for HIV drug to try on coronavirus. (2020, April 20). Reuters. https://www.reuters.com/article/us-health-coronavirus-russia-hiv-exclusi-idUSKBN2220W1

-

-

-

Postdocs in crisis: Science cannot risk losing the next generation. (2020). Nature, 585(7824), 160–160. https://doi.org/10.1038/d41586-020-02541-9

-

-

www.thelancet.com www.thelancet.com

-

Chatterjee, Patralekha. ‘Is India Missing COVID-19 Deaths?’ The Lancet 396, no. 10252 (5 September 2020): 657. https://doi.org/10.1016/S0140-6736(20)31857-2.

-

-

www.hsph.harvard.edu www.hsph.harvard.edu

-

Boston, 677 Huntington Avenue, & Ma 02115 +1495‑1000. (2020, March 4). Coronavirus (COVID-19): Press Conference with Marc Lipsitch, 03/04/20. News. https://www.hsph.harvard.edu/news/features/coronavirus-covid-19-press-conference-with-marc-lipsitch-03-04-20/

-

-

www.thelancet.com www.thelancet.com

-

Yelin, D., Wirtheim, E., Vetter, P., Kalil, A. C., Bruchfeld, J., Runold, M., Guaraldi, G., Mussini, C., Gudiol, C., Pujol, M., Bandera, A., Scudeller, L., Paul, M., Kaiser, L., & Leibovici, L. (2020). Long-term consequences of COVID-19: Research needs. The Lancet Infectious Diseases, 0(0). https://doi.org/10.1016/S1473-3099(20)30701-5

-

- Aug 2020

-

annehelen.substack.com annehelen.substack.com

-

Petersen, A. H. (n.d.). Between f**ked and a hard place. Retrieved August 30, 2020, from https://annehelen.substack.com/p/between-fked-and-a-hard-place

-

-

hscif.org hscif.org

-

Humanities & Social Change (2020, April 30). Cultures of expertise and politics of behavioral science: A conversation with Erik Angner. https://hscif.org/cultures-of-expertise-and-politics-of-behavioral-science-a-conversation-with-erik-angner/

-

-

-

Hoffman, J. (2020, August 16). Fearing a ‘Twindemic,’ Health Experts Push Urgently for Flu Shots. The New York Times. https://www.nytimes.com/2020/08/16/health/coronavirus-flu-vaccine-twindemic.html

-

-

-

Baker, S. R., Bloom, N., & Terry, S. J. (2020). Using Disasters to Estimate the Impact of Uncertainty (Working Paper No. 27167; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27167

-

-

elemental.medium.com elemental.medium.com

-

ScD, N. N. A. (2020, June 11). A Guide to Understanding Pandemic Predictions. Medium. https://elemental.medium.com/a-guide-to-understanding-pandemic-predictions-8ae3439b8224

-

-

csbs.research.illinois.edu csbs.research.illinois.edu

-

Understanding Contemporary Challenges – Center for Social & Behavioral Science. (n.d.). Retrieved August 26, 2020, from https://csbs.research.illinois.edu/understandingcontemporarychallenges/

-

-

www.indiebound.org www.indiebound.org

-

The Lady’s Handbook for Her Mysterious Illness: A Memoir | IndieBound.org. (n.d.). Retrieved August 26, 2020, from https://www.indiebound.org/book/9780385534079

-

-

psyarxiv.com psyarxiv.com

-

Fife, D., Lung, M., Sullivan, N., & Young, C. (2020). When Values Collide: Why Scientists Argue About Open Science and How to Move Forward [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/q9d28

-

-

riskytalk.libsyn.com riskytalk.libsyn.com

-

Risky Talk: Communicating Evidence in a Pandemic. (n.d.). Retrieved August 24, 2020, from https://riskytalk.libsyn.com/communicating-evidence-in-a-pandemic

-

-

www.forbes.com www.forbes.com

-

Togoh, I. (n.d.). After Hydroxychloroquine, Trump Is Now Seeking To Get Another Unproven Drug Approved By The FDA: Report. Forbes. Retrieved August 22, 2020, from https://www.forbes.com/sites/isabeltogoh/2020/08/17/after-hydroxychloroquine-trump-is-now-seeking-to-get-another-unproven-drug-approved-by-the-fda-report/

-

-

www.ijidonline.com www.ijidonline.com

-

Monforte, A. d’Arminio, Tavelli, A., Bai, F., Marchetti, G., & Cozzi-Lepri, A. (2020). Effectiveness of hydroxychloroquine in COVID-19 disease: A done and dusted deal? International Journal of Infectious Diseases, 99, 75–76. https://doi.org/10.1016/j.ijid.2020.07.056

-

-

-

Ludvigson, S. C., Ma, S., & Ng, S. (2020). Covid19 and the Macroeconomic Effects of Costly Disasters (Working Paper No. 26987; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w26987

-

-

www.nber.org www.nber.org

-

Harris, J. E. (2020). Reopening Under COVID-19: What to Watch For (Working Paper No. 27166; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27166

-

-

www.nber.org www.nber.org

-

Barnett, M., Buchak, G., & Yannelis, C. (2020). Epidemic Responses Under Uncertainty (Working Paper No. 27289; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27289

-

-

www.nber.org www.nber.org

-

Bordo, M. D., Levin, A. T., & Levy, M. D. (2020). Incorporating Scenario Analysis into the Federal Reserve’s Policy Strategy and Communications (Working Paper No. 27369; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27369

-

-

www.nber.org www.nber.org

-

Eichenbaum, M. S., Rebelo, S., & Trabandt, M. (2020). The Macroeconomics of Testing and Quarantining (Working Paper No. 27104; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27104

-

-

www.nber.org www.nber.org

-

Diebold, Francis X. ‘Real-Time Real Economic Activity: Exiting the Great Recession and Entering the Pandemic Recession’. Working Paper. Working Paper Series. National Bureau of Economic Research, July 2020. https://doi.org/10.3386/w27482.

-

-

www.thelancet.com www.thelancet.com

-

Kalk, A., & Schultz, A. (2020). SARS-CoV-2 epidemic in African countries—Are we losing perspective? The Lancet Infectious Diseases, 0(0). https://doi.org/10.1016/S1473-3099(20)30563-6

-

-

covid-19.iza.org covid-19.iza.org

-

Economic Policies for COVID-19. COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved August 7, 2020, from https://covid-19.iza.org/publications/pp156/

-

-

-

Altig, D., Baker, S. R., Barrero, J. M., Bloom, N., Bunn, P., Chen, S., Davis, S. J., Leather, J., Meyer, B. H., Mihaylov, E., Mizen, P., Parker, N. B., Renault, T., Smietanka, P., & Thwaites, G. (2020). Economic Uncertainty Before and During the COVID-19 Pandemic (Working Paper No. 27418; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27418

-

-

www.nber.org www.nber.org

-

Baker, S. R., Bloom, N., Davis, S. J., & Terry, S. J. (2020). COVID-Induced Economic Uncertainty (Working Paper No. 26983; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w26983

-

-

covid-19.iza.org covid-19.iza.org

-

An Economic Model of the COVID-19 Epidemic: The Importance of Testing and Age-Specific Policies. COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved August 4, 2020, from https://covid-19.iza.org/publications/dp13265/

-

-

covid-19.iza.org covid-19.iza.org

-

Unemployment Paths in a Pandemic Economy. COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved July 29, 2020, from https://covid-19.iza.org/publications/dp13294/

-

-

covid-19.iza.org covid-19.iza.org

-

Sudden Stop: When Did Firms Anticipate the Potential Consequences of COVID-19?. COVID-19 and the Labor Market. (n.d.). IZA – Institute of Labor Economics. Retrieved July 29, 2020, from https://covid-19.iza.org/publications/dp13457/

-

- Jul 2020

-

-

Ellison, G. (2020). Implications of Heterogeneous SIR Models for Analyses of COVID-19 (Working Paper No. 27373; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27373

-

-

www.nber.org www.nber.org

-

Liu, L., Moon, H. R., & Schorfheide, F. (2020). Panel Forecasts of Country-Level Covid-19 Infections (Working Paper No. 27248; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27248

-

-

www.sciencemag.org www.sciencemag.org

-

MadhusoodananJul. 20, J., 2020, & Pm, 5:05. (2020, July 20). ‘Ethically troubling.’ University reopening plans put professors, students on edge. Science | AAAS. https://www.sciencemag.org/careers/2020/07/ethically-troubling-university-reopening-plans-put-professors-students-edge

-

-

-

Starominski-Uehara, M. (2020). Brief Communication Analysis of Brazilian Presidency during COVID-19 [Preprint]. SocArXiv. https://doi.org/10.31235/osf.io/jr7eq

-

-

osf.io osf.io

-

Starominski-Uehara, M. (2020). Governance in Crisis: Institutionalizing Reflective Report to Guide Decision Making Under Uncertainty [Preprint]. SocArXiv. https://doi.org/10.31235/osf.io/y3nsa

-

-

docs.google.com docs.google.com

-

COVID-19 Social Science Tracker - Google Sheets

Tags

- policy

- unofficial

- isolation

- analysis

- uncertainty

- lang:en

- community

- mental health

- international

- conspiracy theory

- sheets

- preprint

- government

- social norm

- social distancing

- infection

- is:other

- tracker

- misinformation

- research

- healthcare

- medicine

- social science

- COVID-19

- spreadsheet

- data collection

- publication

- behavior

- social media

Annotators

URL

-

-

osf.io osf.io

-

Bernardi, F., Cozzani, M., & Zanasi, F. (2020). Social inequality and the risk of being in a nursing home during the COVID-19 pandemic [Preprint]. SocArXiv. https://doi.org/10.31235/osf.io/ksefy

-

-

www.youtube.com www.youtube.com

-

McConnell, J. (2020, June 11). COVID-19: The current situation and prospects for the UK and the world. Aga Khan Foundation. https://www.youtube.com/watch?v=6VK_2uCA76s

-

-

twitter.com twitter.com

-

New Scientist on Twitter: “Thread on #covid19 trends in the US: Coronavirus infections have surged since the start of June from around 20,000 new cases a day to over 60,000. (1/4) https://t.co/wVFwHWczYR” / Twitter. (n.d.). Twitter. Retrieved July 19, 2020, from https://twitter.com/newscientist/status/1283387188391149571

-

-

twitter.com twitter.com

-

Carl T. Bergstrom on Twitter: “1. In short, no. This is going to take a detailed thread to unpack.” / Twitter. (n.d.). Twitter. Retrieved July 18, 2020, from https://twitter.com/CT_Bergstrom/status/1270226183485976584

-

-

news.sky.com news.sky.com

-

Coronavirus: The inside story of how UK’s “chaotic” testing regime “broke all the rules.” (n.d.). Sky News. Retrieved July 17, 2020, from https://news.sky.com/story/coronavirus-the-inside-story-of-how-uks-chaotic-testing-regime-broke-all-the-rules-12022566

-

-

www.ncbi.nlm.nih.gov www.ncbi.nlm.nih.gov

-

Bae, J.-M. (2014). The clinical decision analysis using decision tree. Epidemiology and Health, 36. https://doi.org/10.4178/epih/e2014025

-

-

www.youtube.com www.youtube.com

-

LSE. (2020, May 13) Behavioural Science in the Context of Great Uncertainty | LSE Online Event. https://www.youtube.com/watch?v=2X0aTk3f4oI&feature=youtu.be

-

-

colab.plymouthcreate.net colab.plymouthcreate.net

-

This model is the most flexible and open-ended of the four; your goal as an instructor is not to design a full-fledged semester of material, activities, and assessments. Rather, your goal is to work with your class to design and become a learning community, working collaboratively and individually towards your determined learning goals. For this to work you should have: a set of possible/preferred learning objectives for your classa library of course materials, preferably with as much as possible in digital formata suggested list of digital tools and technologies that you’re comfortable from with a list of possible assignment/project/assessment ideas that are related to your learning objectivesa willingness to experiment and invite your students into the teaching & learning process. At the onset of class you will need to facilitate a conversation among you and your students about how the class will unfold. This can be done in small groups f2f, via an online communication tool, or in a hybrid mix of both. As a community you should plan on addressing the following: what are our objectives as a learning community? what kind of work could we engage in to meet these objectives? what physical/virtual spaces would we like to work in? how/when do we want to meet in these spaces?how do we want to measure (assess) if an objective has been met?what rules and policies should govern our work? how will we work virtually and respect everyone’s boundaries and personal situations? how will we work f2f and respect public health recommendations and personal situations? You will probably need to spend at least the first 1-2 weeks answering these questions together and then designing a plan for your course. Make sure you and your students talk through various complications: what if the university’s policies about meeting f2f change? what if classes are forced to move entirely virtual/remote? what someone (students or professor!) gets sick?

This is the one for me!!!!

-

c

Apologies for highlighting whole swaths of paragraphs but it can't be helped sometimes lol.

-

Finally, these are NOT meant to be comprehensive. Instead, imagine these models along a continuum of opportunity. Your challenge is to determine where your courses could fit between and among the proposals.

I'm wondering how much or how little faculty will need to change their curriculum/delivery depending on the various inevitable changes that we can't exactly predict will happen this school year. For those faculty member purposefully switching online, what changes have they made already, and what changes will become necessary in the near future?

-

-

www.youtube.com www.youtube.com

-

Communicating statistics, risk and uncertainty in the age of Covid—Prof. David Spiegelhalter. (2020, June 30). https://www.youtube.com/watch?v=Dq7W1l7RptQ&feature=youtu.be

-

-

osf.io osf.io

-

Méndez, P. F. (2020). Blue uncertainty: Warding off systemic risks in the Anthropocene – Lessons from COVID-19 [Preprint]. SocArXiv. https://doi.org/10.31235/osf.io/z2br5

-

-

twitter.com twitter.com

-

Maarten van Smeden on Twitter: “Let’s talk about the ‘risk factors’ for COVID-19 for a moment 1/n” / Twitter. (n.d.). Twitter. Retrieved July 11, 2020, from https://twitter.com/maartenvsmeden/status/1249702560442785794

-

-

news.berkeley.edu news.berkeley.edu

-

Calm amid COVID. (2020, April). Berkeley News. Retrieved July 10, 2020, from https://news.berkeley.edu/topics/calm-amid-covid/

-

-

-

Coggon, D., Croft, P., Cullinan, P., & Williams, A. (2020). ASSESSMENT OF WORKERS PERSONAL VULNERABILITY TO COVID-19 USING COVID-AGE. MedRxiv, 2020.05.21.20108969. https://doi.org/10.1101/2020.05.21.20108969

-

-

psyarxiv.com psyarxiv.com

-

Miller, J. G., Chahal, R., Kirshenbaum, J. S., Ho, T. C., Gifuni, A. J., & Gotlib, I. (2020). Heart Rate Variability Moderates the Link Between COVID-19 Stress and Emotional Problems in Adolescents: Evidence for Differential Susceptibility [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/mp7wt

-

-

psyarxiv.com psyarxiv.com

-

Chatterjee, A., & Chatterjee, A. (2020). Managing through uncertain times: A study to understand the effects of conducting socio-academic life online during COVID-19. https://doi.org/10.31234/osf.io/vcbrw

-

-

www.nytimes.com www.nytimes.com

-

Mandavilli, A. (2020, July 4). 239 Experts With One Big Claim: The Coronavirus Is Airborne. The New York Times. https://www.nytimes.com/2020/07/04/health/239-experts-with-one-big-claim-the-coronavirus-is-airborne.html

-

-

-

These Canadians say they suffered COVID-19 symptoms for months. (n.d.). Global News. Retrieved July 5, 2020, from https://globalnews.ca/news/7107137/coronavirus-long-term-symptoms/

-

-

www.thelancet.com www.thelancet.com

-

Horton, R. (2020). Offline: It’s time to convene nations to end this pandemic. The Lancet, 396(10243), 14. https://doi.org/10.1016/S0140-6736(20)31488-4

-

- Jun 2020

-

leibniz-phd.net leibniz-phd.net

-

Leibniz PhD Network - Mental Health for Doctoral Researchers During COVID-19 Webinar

-

-

psyarxiv.com psyarxiv.com

-

Im, H., & Chen, C. (2020). Social Distancing Around the Globe: Cultural Correlates of Reduced Mobility [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/b2s37

-

-

twitter.com twitter.com

-

A Marm Kilpatrick on Twitter: “What is #herdimmunity threshold for #COVID19? A topic of much discussion due to large uncertainty & huge consequences for long term impact. New paper illustrates 1 key aspect that can reduce it substantially (spoiler: we still don’t know value). Thread. https://t.co/Sgrg1yrlOq” / Twitter. (n.d.). Twitter. Retrieved June 27, 2020, from https://twitter.com/diseaseecology/status/1275595167936868352

-

-

www.youtube.com www.youtube.com

-

Part 1—Webinar Coping Strategies COVID-19. (2020, April 17). https://www.youtube.com/watch?list=PLzyuHsPaw9H20TuO_c8G2pfcyCuJ2ro7Y&v=-7UQe6xnV5g&feature=emb_logo

-

-

www.nature.com www.nature.com

-

Saltelli, A., Bammer, G., Bruno, I., Charters, E., Di Fiore, M., Didier, E., Nelson Espeland, W., Kay, J., Lo Piano, S., Mayo, D., Pielke Jr, R., Portaluri, T., Porter, T. M., Puy, A., Rafols, I., Ravetz, J. R., Reinert, E., Sarewitz, D., Stark, P. B., … Vineis, P. (2020). Five ways to ensure that models serve society: A manifesto. Nature, 582(7813), 482–484. https://doi.org/10.1038/d41586-020-01812-9

-

-

www.nature.com www.nature.com

-

Woolston, C. (2020). Take our postdoctoral-researcher survey. Nature, d41586-020-01863-y. https://doi.org/10.1038/d41586-020-01863-y

-

-

www.theatlantic.com www.theatlantic.com

-

Tufekci, Z. (2020, April 2). Don’t Believe the COVID-19 Models. The Atlantic. https://www.theatlantic.com/technology/archive/2020/04/coronavirus-models-arent-supposed-be-right/609271/

-

-

psyarxiv.com psyarxiv.com

-

Kim, L. E., Dr, & Asbury, K. (2020, June 18). Teachers' initial experiences of COVID-19. https://doi.org/10.31234/osf.io/xn9ey

-

-

-

Zelner, J., Riou, J., Etzioni, R., & Gelman, A. (2020). Accounting for Uncertainty During a Pandemic. ArXiv:2006.08745 [Physics, q-Bio, Stat]. http://arxiv.org/abs/2006.08745

-

-

www.medscape.com www.medscape.com

-

Dean, N. E. (2020, June 15). Asymptomatic Transmission? We Just Don’t Know. Medscape. Retrieved June 16, 2020, from http://www.medscape.com/viewarticle/932246

-

-

www.newscientist.com www.newscientist.com

-

Page Le, M. (2020, June 13). How can international travel resume during the coronavirus pandemic? New Scientist. https://www.newscientist.com/article/2246024-how-can-international-travel-resume-during-the-coronavirus-pandemic/

-

-

wellcomeopenresearch.org wellcomeopenresearch.org

-

Friston KJ, Parr T, Zeidman P et al. Dynamic causal modelling of COVID-19 [version 1; peer review: awaiting peer review]. Wellcome Open Res 2020, 5:89 (https://doi.org/10.12688/wellcomeopenres.15881.1)

-

-

twitter.com twitter.com

-

Twitter. (n.d.). Twitter. Retrieved June 12, 2020, from https://twitter.com/jamesheathers/status/1271058689970114560

-

-

psyarxiv.com psyarxiv.com

-

Chatterjee, A., & Chatterjee, A. (2020). Managing through uncertain times: A study to understand the effects of conducting socio-academic life online during COVID-19 [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/zjaey

-

-

bostonreview.net bostonreview.net

-

Lipsitch, M. (2020, May 12). Good Science Is Good Science [Text]. Boston Review. http://bostonreview.net/science-nature/marc-lipsitch-good-science-good-science

-

-

www.theatlantic.com www.theatlantic.com

-

Yong, E. (2020, June 4). COVID-19 Can Last for Several Months. The Atlantic. https://www.theatlantic.com/health/archive/2020/06/covid-19-coronavirus-longterm-symptoms-months/612679/

-

-

www.theatlantic.com www.theatlantic.com

-

Gutman, R. (2020, May 8). You’ll Probably Never Know If You Had the Coronavirus in January. The Atlantic. https://www.theatlantic.com/health/archive/2020/05/us-coronavirus-cases-january/611305/

-

-

www.thecut.com www.thecut.com

-

Chow, K. (2020, May 6). There’s No Way to Prepare for Grief. The Cut. https://www.thecut.com/2020/05/theres-no-way-to-prepare-for-grief.html

-

-

twitter.com twitter.com

-

Yong, E. (2020, May 23). "Hello! More of you have started following me in the last weeks since I last did this, so let me introduce you to YET MORE people I respect, who've created some pandemic writing that's really stuck with me. (And do check out the original thread below.)" Twitter. https://twitter.com/edyong209/status/1263996750404243462

-

-

twitter.com twitter.com

-

Angner, E. (2020, May 11). "Terrific assessment of projections of demand for Swedish ICU beds. The first two panels are model-based projections by academics; the third is a simple extrapolation by the public-health authority; the fourth is the actual outcome /1." Twitter. https://twitter.com/SciBeh/status/1260121561861939200

-

-

www.reuters.com www.reuters.com

-

Ahlander, J. & Pollard, N. (2020, May 20). Swedish antibody study shows long road to immunity as COVID-19 toll mounts. Reuters. https://www.reuters.com/article/us-health-coronavirus-sweden-strategy-idUSKBN22W2YC

-

-

psyarxiv.com psyarxiv.com

-

Meyerhoff, H. S., Brand, A.-K., & Scholl, A. (2020). In Case of Doubt for the Suspicion?: When People Falsely Remember Facts in the News as Being Uncertain. https://doi.org/10.31234/osf.io/rct7a

-

-

twitter.com twitter.com

-

Ian Lavery MP on Twitter

-

- May 2020

-

psyarxiv.com psyarxiv.com

-

Padilla, L., Kay, M., & Hullman, J. (2020). Uncertainty Visualization [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/ebd6r

-

-

eu.usatoday.com eu.usatoday.com

-

Coronavirus pandemic: Tips for how to cope with uncertainty, worry. (n.d.). Usatoday. Retrieved April 9, 2020, from https://www.usatoday.com/story/news/nation/2020/04/04/coronavirus-pandemic-tips-cope-uncertainty-worry/5097190002/

-

-

psyarxiv.com psyarxiv.com

-

Farias, J. E. M., & Pilati, R. (2020). Violating social distancing amid COVID-19 pandemic: Psychological factors to improve compliance [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/apg9e

-

-

-

www.psychologicalscience.org www.psychologicalscience.org

-

Association for Psychological Science - APS. ‘APS Backgrounder Series: Psychological Science and COVID-19: Conspiracy Theories’. Accessed 29 May 2020. https://www.psychologicalscience.org/news/backgrounders/covid-19-conspiracy-theories.html.

-

-

www.prospectmagazine.co.uk www.prospectmagazine.co.uk

-

Rusbridger, Alan. ‘Sage Coronavirus Expert: We’ve Had an Epidemic That to Some Degree Could Have Been Avoided’. Accessed 29 May 2020. https://www.prospectmagazine.co.uk/science-and-technology/alan-rusbridger-sage-jeremy-farrar-covid-19-coronavirus-dominic-cummings-herd-immunity.

-

-

psyarxiv.com psyarxiv.com

-

Dhami, M. K., & Mandel, D. R. (2020). UK and US policies for communicating probability in intelligence analysis: A review [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/kuyhb

-

-

-

Ciranka, S. K., & van den Bos, W. (2020). A Bayesian Model of Social Influence under Risk and Uncertainty [Preprint]. PsyArXiv. https://doi.org/10.31234/osf.io/mujek

-

-

psyarxiv.com psyarxiv.com

-

Zeppegno, P., Gramaglia, C., Guerriero, C., Madeddu, F., & Calati, R. (2020, May 17). Psychological/psychiatric impact of the novel coronavirus outbreak: lessons learnt from China and call for timely crisis interventions in Italy. https://doi.org/10.31234/osf.io/z26yk

-

-

science.sciencemag.org science.sciencemag.org

-

Cobey, S. (2020). Modeling infectious disease dynamics. Science, 368(6492), 713–714. https://doi.org/10.1126/science.abb5659

-

-

psyarxiv.com psyarxiv.com

-

Uygun Tunç, D., & Tunç, M. N. (2020, May 13). Replication Under Underdetermination: Introducing Systematic Replications Framework. https://doi.org/10.31234/osf.io/pdm7y

-

-

-

Scientific Advice to European Policy in a Complex World. European Commission. https://ec.europa.eu/info/research-and-innovation/strategy/support-policy-making/scientific-support-eu-policies/group-chief-scientific-advisors/scientific-advice-european-policy-complex-world_en

Tags

- science

- is:webpage

- European Commission

- decision making

- guideline

- uncertainty

- lang:en

- EU

- advice

- complexity

- policy

- evidence

Annotators

URL

-

-

www.theguardian.com www.theguardian.com

-

Elias, M. (2020, May 9). Fear, judgment, hysteria: Six survivors talk about life after coronavirus. The Guardian. https://www.theguardian.com/world/2020/may/10/fear-judgment-hysteria-six-survivors-talk-about-life-after-coronavirus

-

-

www.tandfonline.com www.tandfonline.com

-

Ruiu, M. L. (2020). Mismanagement of Covid-19: Lessons learned from Italy. Journal of Risk Research, 1–14. https://doi.org/10.1080/13669877.2020.1758755

-

-

paper.li paper.li

-

Jameson, J. (2020 May 8). #Leadership-Research. Paper.li. https://paper.li/jjameson/leadership-research

-

-

www.nejm.org www.nejm.org

-

Zagury-Orly, I., & Schwartzstein, R. M. (2020). Covid-19—A Reminder to Reason. New England Journal of Medicine, NEJMp2009405. https://doi.org/10.1056/NEJMp2009405

-

-

psyarxiv.com psyarxiv.com

-

Watzek, J., & Brosnan, S. (2020, April 30). Capuchin and rhesus monkeys show sunk cost effects in a psychomotor task. https://doi.org/10.31234/osf.io/qtgru

-

-

www.lse.ac.uk www.lse.ac.uk

-